Financial planning for YOUR life and lifestyle™

Are you financially prepared for retirement?

Take our online quiz to learn how prepared you are for your golden years.

Financial planning is not one big thing. It is hundreds of little things.™

ProVise Management Group, LLC is a nationally recognized, fee-based financial planning and investment management firm with offices in Tampa and Clearwater, Florida.* With over three decades of experience, we are ready to help you step into the financial freedom you deserve with a range of financial services personalized to your needs.

Are you uneasy about your financial future?

Do you find yourself feeling anxious about retirement and the unexpected expenses that may come up during those golden years? If this sounds like you, reach out to one of our Tampa Bay locations and we’ll walk you through your financial roadmap and create a customized strategy specific to your current and future goals.

of Americans are anxious about their financial situation¹

Our money-back guarantee on financial plans

ProVise Management Group has been helping people make their financial goals a reality for more than 35 years.

We are so committed to client satisfaction that we offer a money-back guarantee on all written financial plans.

If you’re unhappy with your plan for any reason, simply return it. We’ll refund 100% of the fee.

Simple as that.

Serving Tampa Bay and beyond since 1986

At ProVise, we have an entire team of designated CERTIFIED FINANCIAL PLANNER™ professionals dedicated to advising clients on the best financial strategies to help them reach their goals.

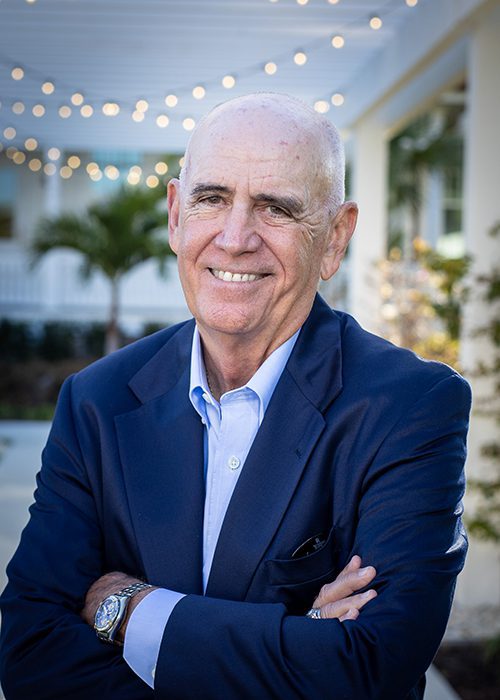

V. Raymond Ferrara, CFP®

Executive Chair, Chief Compliance Officer

Eric R. Ebbert, CFP®, MBA

CEO

Jon Brethauer, CFP®, AIF®, CPFA, MBA

President

Nancy Croy Ramey, CFP®, MBA

Executive Vice President & CFO

Shane O’Hara, CFP®

Executive Vice President, Senior Financial Planner

Susan Washburn, CFP®, JD

Senior Financial Planner

Sandy Risgaard, CFP®

Senior Financial Planner

Russell J. Campbell, CFP®, CIMA®

Senior Financial Planner

Paul H. Auslander, CFP®

Director of Financial Planning

Steve Athanassie, CFP®, AIFA®, CPFA

Director of Private Wealth Management

Stephen J. Csenge, CFP®, AIF®

Senior Financial Planner

Daniel Mannix, CFA®

Portfolio Manager

Tom Harrington, CFP®, AIF®, CRPS®

Retirement Plan Advisor

Oscar Skjaerpe, CFP®

Financial Planner

Holly Harman, FPQP™

Financial Planning Associate

![V. Raymond Ferrara[71]](https://www.provise.com/wp-content/uploads/2022/11/V.-Raymond-Ferrara71-e1668703841158.png)