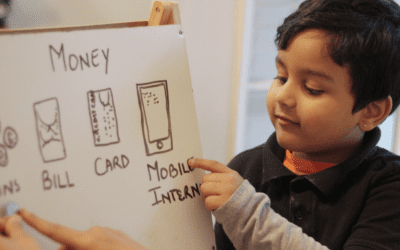

The holiday season is a time for comfort, joy, and celebration. As we gather with family and friends, it’s also the perfect time to have meaningful conversations with the ones we love. In a world driven by economic complexities, the importance of financial literacy cannot be overstated.

Wealth Management

Protecting Generational Wealth: Key Tips for Securing a Lasting Legacy

Asset protection is one of the most important, if not the most important, financial planning areas for physicians. However, we’ve found that it isn’t a topic that gets enough coverage in the personal finance community and in today’s litigious environment, it is vital that you have an asset protection strategy.

When Should Physicians Hire a Financial Advisor?

Physicians’ financial planning is unique, with typically a short time between finishing their training and when they step away from practicing medicine. Less time working compared to other professions generally leads to different rules to becoming financially independent. With such busy schedules of seeing patients and limited time to spare, a way that physicians can make sure they are on the right track and increase their odds of financial success is by hiring a financial advisor. But how do they know the right time to hire an advisor and partner with an expert?

3 Essential Tips to Start Building Generational Wealth

From 1920 to 2020, the U.S. population of adults 65 and older grew almost five times faster than the total population. As of the 2020 census, this group had reached 55.8 million, representing 16.8% of the U.S. population. With the increasing number of adults in the United States aged 65 and older, it’s worrisome that their overall financial health literacy remains relatively low.

Cash Management: How to Maximize Your Interest

Only 18 months ago, managing cash was not something that anyone was really thinking about. However, the Federal Reserve’s Federal Open Market Committee (FOMC) has raised interest rates 11 times since March 2022 to combat the worst inflation the U.S. has seen in 40 years, taking short term rates from 0% to over 5%.

Reverse Budgeting: How to Pay Yourself First

Are you tired of feeling overwhelmed by your expenses, unsure where your money is going, and struggling to grow your savings? In an article earlier this month on avoiding lifestyle inflation, I briefly described one strategy called “reverse budgeting” and how we’ve found it to be a helpful way for families to gain control over their finances.

Recent Comments