TAX SEASON IS OVER… FOR MOST OF US

The last day for tax returns is typically April 15th, but because it fell on a Saturday this year, it was postponed to Monday, April 17th. However, that was Patriot’s Day which is celebrated on the third Monday in April and is the traditional day for the Boston Marathon. As a result, tax returns needed to be filed by April 18th unless you filed an extension which gives you until October 15th. If you didn’t get your taxes done by this date, you still had to send in the money you owe for 2022 plus the money for the first quarterly payment for 2023. During our upcoming meetings with our clients, we would be happy to review your tax return for opportunities to help reduce your taxes in 2023 and beyond. If you would take a few moments to upload your tax return(s) to our secure vault through the ProVise portal, it will notify us that you did so, and we can be prepared when we meet next. Otherwise, just bring it with you.

ONE INDICATOR SAYS INFLATION IS ABATING

About this time a year ago, I Bonds had a coupon of over 9% and are designed to pay a real rate of return after inflation. A new interest rate for I Bonds is set every six months in November and May. Last November the rate declined to 6.89%, but this May the rate will be reduced to 3.79%. It is still not a bad rate but considering that a one-year Treasury is paying 4.7%, the deal may not be so good. When you buy an I bond you must hold it for at least one year, and if you cash it in within five years, you lose three months of interest, making it a steep penalty at current interest rates but not as bad if you wait until the interest rate comes down.

SOCIAL SECURITY WAGE BASE FOR 2024 ESTIMATED

Last year the wage base and benefits increased 8% because of inflation. Inflation is still in the vocabulary this year, but not by nearly that amount. The first estimate came out a few weeks ago and it is expected to rise to $168,600 in 2024 up from $160,200. This represents a 5.2% increase year over year of current taxable wages.

MEDICARE PREMIUM SURCHARGES

Unbeknown to many until it happens to them, Medicare Part B (doctors and tests) insurance premiums can go up and go up a lot. The base monthly premium rate for 2023 is $164.90 for those that file jointly but can rise to as much as $560.50 if the joint income is over $500,000. The same theory applies to Part D (drugs) with a base rate of $0 and an upper amount of $76.40. There is a two-year look back on income. In 2023, it is your income in 2021 that counts. This can be a BIG surprise if one sells a business, has large capital gains, some other windfall of income, or the death of a spouse. Worse, it is based on modified income which does not take into account deductions for medical expenses, mortgage interest, charitable contributions, etc. How can you avoid this happening to you?

Here are a few ideas to minimize or perhaps eliminate the surcharge.

- If you are still working, put as much as you can into tax-deductible retirement plans.

- If retiring, consider delaying Social Security as long as possible.

- From an investment perspective, make sure you are doing tax loss harvesting to lower any capital gains income.

- Look at the Medicare Advantage plans benefits that do not have any premiums based on income but may limit the doctors you can see and require approval for tests.

- If you have a life-changing event (retirement, divorce, death of a spouse, or significantly lower income) you can appeal.

WHAT THE THREE LITTLE PIGS CAN TEACH US

In the last ProVise Perspective$, we used the fable of The Tortoise and the Hare to talk about how racing from one thing to another like the hare usually loses to the slow, steady, and patient tortoise when it comes to investing. Staying with these themes, this time we bring you The Three Little Pigs to show you the importance of a diversified portfolio.

A Straw House

Too often, investors may be like the first pig: eager to get started, quickly building a house or portfolio from whatever is nearby. That pig was quick and efficient, proud of being the first of his siblings to complete his new abode. But it wasn’t long before the Big Bad Wolf arrived, threatening to blow the new house down. Sure enough, with just a little huffing and puffing, down came the rapidly built house.

The straw approach to portfolio building can be tempting. After all, who wouldn’t want their investments to grow overnight? Why can’t we just buy some Bitcoin and retire? The challenge is that the faster a house or portfolio goes up, often the easier it is to come down. The Big, Bad Work always lurks around the corner.

In 2021, for instance, bitcoin rose by 66%. During that year, the number of users of crypto-exchange apps doubled. But the following year, bitcoin dropped by 65%. Anyone who had held for those two years, they would have lost over 40% of their investment. One study suggests that “around three-quarters of users have lost money on their Bitcoin investments.”

With his straw house blown down, the first pig couldn’t double down and simply build another house, so he took refuge at his sister’s place.

A Twig House

Just as some investors seek the quick path to riches, others prefer to hide and avoid any losses, much like the second pig. Keenly aware of the Big, Bad Wolf’s destructive power, she had tightly bound her twigs together and kept the house small, with wads

of cash stuck under her little mattress. She wasn’t going to take the risk of building a flimsy structure. Alone in her twig house, the second pig slept easily, even after her houseless brother arrived.

Then the Big, Bad Wolf showed up. But this time, the wolf didn’t huff and puff. He simply waited. As time ticked by, those carefully stored wads of cash became less valuable, and the second pig’s sense of security dwindled.

Taking too little risk can be just as detrimental to a portfolio as taking too much risk. For instance, in the US, from 1900 to 2021, inflation averaged about 2% per year, a modest-sounding amount. But compound that rate year after year, and that bucket of cash would have lost 97% of its buying power. Keeping your hard-earned money in cash means that you won’t suffer the big drawdowns that a bear market can bring, but it pretty much guarantees that your assets will lose value over time due to inflation and the effects of compounding interest in a reverse direction.

A Brick House

No surprise that the first and second pigs eventually ended up at their brother’s place. His house had taken so long to put up that he was just putting the finishing touches on it when they arrived. He had carefully selected his materials with small amounts of straw and twigs interspersed with his hefty bricks to form a commanding structure. It was the diversity of materials that allowed the house to stand even as the Big, Bad Wolf howled outside.

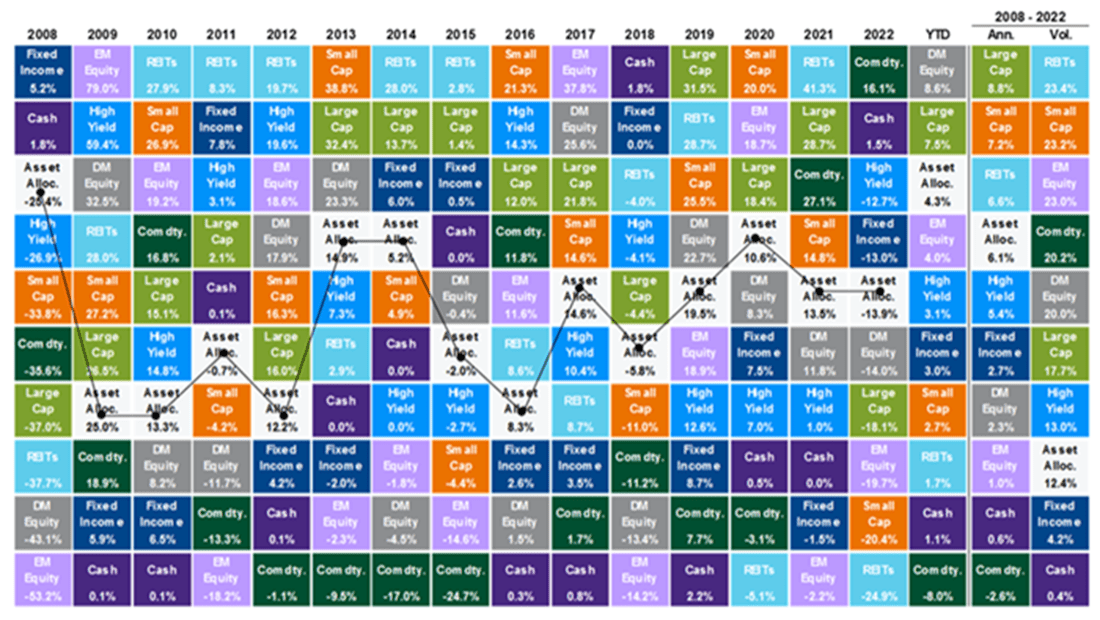

If you’ve read articles published by the financial industry, including here, you’ve probably seen something to the effect of “past performance does not guarantee future returns.” In looking at the annual performance of various asset classes, it becomes clear that rarely is one asset class in the top slot from one year to the next. The graphic below is often called the “quilt chart” because it looks much like a grandmother’s blanket crafted from a variety of fabric scraps.

In 2008, for instance, fixed income outperformed other asset classes as the global financial crisis drove large cap stocks down 37% and emerging market equities down over 50%. The following year, however, results were almost the complete opposite as stocks soared – emerging market equities up almost 80% – while fixed income lagged, rising a mere 6%.

The unsung hero of the quilt chart is the white box showing a diversified portfolio, the investment equivalent of a brick house, bumping along the middle – never first, never last. After fifteen years, the diversified portfolio earned an impressive 6% return, despite two bear markets, and importantly did so with one of the lowest levels of risk.

Quilt Chart: Asset Class Returns by Year, Ranked

The most important takeaway from the pigs’ experience is that the Big, Bad Wolf will always come knocking, so it’s best to prepare ahead of time. Not by relying on the high-risk straw investments nor by hiding in the no-risk, no-reward twig portfolio. Drawing on a full spectrum of investments, an investor can build a portfolio that can much more easily weather the Wolf’s tantrums.

Since our founding in 1986, we have been the tortoise and the third little pig. As said many times, we are vanilla ice cream. Nothing exciting to talk about at the cocktail party on Saturday night, but who doesn’t like vanilla ice cream over the long term?

All the performance data shown represents past performance. Past performance is not an indicator of future results.

Source: J.P. Morgan Asset Management, Guide to the Markets.

HAVE SALARIES KEPT UP WITH INFLATION?

There is a silver lining to inflationary environments. Usually, salaries rise to offset some of the pressure consumers face in the form of higher prices for goods and services. The two create a feedback loop as wage increases drive much of the persistent increase in inflation. The most commonly used measure of salaries is the U.S. Bureau of Labor Statistics average hourly earnings of production or nonsupervisory workers on private nonfarm payrolls. That measure peaked back in April of 2020, growing just over 8% year-over-year. Much of that historically high wage growth was due to the substantial job loss among lower-paid workers relative to the prior year period. If we back inflation out of wage growth, as measured by the Consumer Price Index (CPI), real wage growth was 7.75%.

Beginning in 2021, inflation got to levels not seen in four decades and much of the increase was due to severe supply-side shocks like the war in Ukraine and China lockdowns. Meanwhile, wage growth was slowing. To be clear, wages were growing as companies paid up for employees to meet high consumer demand but the impact of unusual year-over-year comparisons at the beginning of the pandemic dissipated. Real wage growth has averaged -1.5% since the beginning of 2021, as 4.75% average wage growth has not been enough to overcome higher consumer prices.

The good news is that real wage growth has been improving this year as inflation has been decreasing. Real wage growth was -0.75% in March 2023, marking the best reading since September 2021. Wages are sticky, meaning it’s difficult to have sustainable periods of negative wage growth because cutting salaries is not a recipe for employee retention. Pair that backstop on wages with a continued decline in inflation and we ultimately expect real wage growth to return to positive territory. In the meantime, excess savings should support U.S. economic growth of which two-thirds is driven by consumer spending.

Recent Comments