ALL THAT GLITTERS IS NOT GOLD

For three nights in April, Taylor Swift took Tampa by storm on her “Eras Tour” stop. Forbes ran a headline reading “Eras Tour Could Net Taylor Swift $500 Million to $1.5 Billion.” Those are some impressive numbers, but we are equally impressed with Taylor’s decision not to invest in the cryptocurrency exchange FTX led by Sam Bankman-Fried who has been indicted on charges of securities fraud and money laundering.

Many celebrities and athletes including NFL quarterback Tom Brady, basketball players Steph Curry and Shaq O’Neil, model Gisele Bundchen, and tennis player Naomi Osaka find themselves facing a lawsuit for endorsing the now-bankrupt cryptocurrency exchange FTX. Swift avoided the crypto debacle by not accepting a $100 million tour sponsorship.

Lucky? Not according to attorney Adam Moskowitz who is bringing the class action lawsuit against FTX’s celebrity endorsers. While in negotiation with FTX to sponsor her “Eras Tour,” Swift showed her business savvy by asking a simple question: “Can you tell me that these are not unregistered securities?”i So, she knows that all that glitters is not gold. “Swifties” might love and connect with her music, but let’s hope that she gains even more fans for her business acumen and for asking the right questions.

FED TURNS UP THE HEAT ONCE AGAIN

As widely expected, the Federal Reserve announced another 25-basis point increase to its benchmark interest rate target. Investors are hoping this is the end of the tightening cycle, with market pricing in a pause from here until reversing course later this year and next. The unprecedented speed at which the Fed has raised interest rates over the last year has been a problem for most asset classes. Over the last two years, stocks have been basically flat (S&P 500 +1%) and bonds are down meaningfully (AGG -9%).

We believe most of the Fed rate hikes are behind us, though expect interest rates to remain higher for longer. This likely creates a choppy investment environment in the near-term but also presents some opportunities for patient investors as the dust settles. The last couple of years have been the culminating effect of reversing a decade and a half of artificially low-interest rates and a return to “real normal” is healthy, in our opinion. We find solace in the attractive long-term investment profile of stocks and bonds amid a near-term environment where patience really is a virtue.

NEW MORTGAGE FEES FOR EVERYONE

Not everyone is excited about the new mortgage fees that went into effect on May 1st for those mortgages backed by Fannie Mae and Freddie Mac. By the way, the two agencies back about 50% of all mortgages. The changes were designed by the Biden administration to make it easier for those with lower credit scores to buy a home given how much they increased in prices. That sounds like a good idea, until you realize the last time the government tried to make housing more affordable it ended badly. Nonetheless, they are in effect, and here are the winners and losers.

In short, those with higher credit scores will pay more in fees going forward and those with lower credit scores will pay less fees. Not all those with a higher score will pay more, but those with a lower downpayment will likely be affected the most. Sounds counterintuitive to many critics. To the supporters, it is billed as risk-based pricing reflecting the reality of those who are likely to default. While these changes may make it “easier” to buy a home, they also make it more “complicated” to determine which mortgage approach should be used by a buyer.

$400 BILL UNABLE TO PAY

If you got an unexpected bill for $400, would you have a problem paying it without taking on debt? According to a Morning Consult report, only 33% said they would have no issue paying the bill, leaving an astounding 77% who do not have the cash. Must be those with a low-income living paycheck to paycheck…right? You couldn’t be more wrong. Twenty percent of those with incomes between $50,000–$100,000 and 8% of those with incomes over $100,000 are in the same situation. All of this is with unemployment at 3.4%. Many people have used up all that stimulus money, which says that future consumer spending will be with credit, not cash. Thus, we see the possibility of slowing consumer spending. Further, many, regardless of income, who find themselves unable to save will put pressure on retirement savings on a long-term basis.

In short, those with higher credit scores will pay more in fees going forward, and those with lower credit scores will pay less fees. Not all those with a higher score will pay more, but those with a lower downpayment will likely be affected the most. Sounds counterintuitive to many critics. To the supporters, it is billed as risk-based pricing reflecting the reality of those likely to default. While these changes may make it “easier” to buy a home, they also make it more “complicated” to determine which mortgage approach should be used by a buyer.

529 PLANS ARE GETTING BETTER

Needless to say, going to college is an expensive proposition. Often, grandparents are willing and able to set up a 529 Plan for a grandchild. However, in the past, grandparent support was treated as cash belonging to the student and therefore decreased the student’s potential financial aid by up to 50%. Beginning with the 2024-25 school year, a student will no longer have to report money that is in a plan owned by someone other than a parent. The same rule will also apply to straight cash gifts.

WOW! HAVE THINGS CHANGED IN 30 YEARS

In the early days of ProVise, we wrote about the $20 trillion wealth transfer that would occur when the parents of Baby Boomers died and passed on their wealth to the “kids”. Fast forward 30 years and Cerulli estimates that the Baby Boomer passing will create a wealth transfer of $84.4 trillion with $72.6 trillion going to the new “kids” and the rest to charity. Maybe this is how many who have not appropriately saved for their retirement are actually planning to retire. It is a plan, but not a good one. It is estimated that it will generate $4.2 trillion in tax dollars for the state and federal governments.

CONSEQUENCES OF DYING WITHOUT A WILL

Dying without a will, also known as dying “intestate,” can have serious consequences for your loved ones and your estate. Without a will, your assets and property will be distributed according to your state’s intestacy laws which may not align with your wishes. Here are some of the consequences of dying without a will:

-

- No Control Over Distribution: When you die without a will, you lose control over who inherits your assets. Your state’s intestacy laws dictate how your property is distributed, typically starting with your closest living relatives.

- No Say in Guardianship: If you have minor children, dying without a will means you have no say in who will become their legal guardian. A court will choose a guardian who may not be your preferred choice.

- Delay and Costs: Dying without a will can also cause delays and extra costs in the probate process. Without clear instructions, the court will spend more time and resources determining how to distribute your assets.

- Family Disputes: When there is no will, family members may argue over who should receive certain assets, leading to disputes that can be emotionally and financially costly.

A will ensures that your assets are distributed according to your wishes and that your children are cared for by the person you choose. It can also help avoid disputes and minimize the costs and delays of probate. If you haven’t created a will yet, speaking with an estate planning attorney is essential to help you create a plan that meets your specific needs and goals.

What Happens if You Die Without a Will? [Updated 2022] | Trust & Will (trustandwill.com)

The Confusing Fallout of Dying Without a Will – WSJ

GOLDILOCKS AND THE THREE BEARS

Previously, we discussed how individuals can successfully build wealth over time by being like the Tortoise and embracing time and consistency. Then, in our last Perspective$, three charming little pigs helped us explore the perils of the fast-to-build and quick-to-come-down portfolio, as well as the too-conservatively built portfolio that shrinks over time. So, what’s an investor to do? This week, we look to Goldilocks to help us uncover how to build the “just right” portfolio.

We have all heard how little Goldilocks, lost in the woods, stumbles upon a cozy cabin. Hungry, she finds three bowls of porridge on the table and without much hesitation, she begins to taste each one. She quickly discovers that the three bowls may be filled with the same ingredients, but they don’t all suit her, much as investors need to identify the right mix of assets that is just right for him or her.

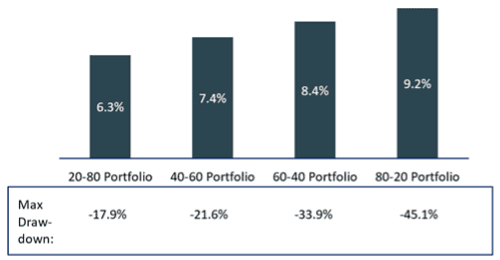

Most individuals have some mixture of stocks and bonds in their portfolio, but the temperature can vary widely depending on the relative size. Stocks, with their hot return potential over time, act as the engine of growth. Though as Goldilocks soon discovered, a too-hot portfolio can also be anxiety-inducing and not appropriate for shorter-term cash needs. In fact, looking back to 1990, a portfolio that held 80% in stocks and just 20% in bonds fell at one point close to 50%.

Enter bonds. Bonds tend to fall much less than stocks (2022 being an exception), cushioning a portfolio in down markets and providing an investor with consistent income. No child will scorch her tongue on a portfolio heavily weighted toward bonds, but that cooler temperature means she may not grow wealth over time. A different portfolio, this time with just 20% in stocks and 80% in bonds, grew one-third less than the hot portfolio above.

Hypothetical Returns of an Investment in the S&P 500 Index & Bloomberg U.S. Aggregate Index

1/1/1990 to 3/31/2023

Past performance is not a reliable indicator of current or future results. Indexes are unmanaged and not subject to fees. It is not possible to invest directly in an index. Note: views are from a U.S. dollar perspective. The rebalanced portfolio is rebalanced on a quarterly basis. Source: Kestra Investment Management with data from Morningstar. Index proxies: S&P 500 Index and Bloomberg U.S. Aggregate Index. Data as of March 31, 2023.

For most investors, that just-right portfolio is somewhere in the middle. Papa Bear, in this instance, had the hot portfolio. He had many more years to work before retirement and was comfortable with the wild ride that a portfolio heavy with stocks can provide. Mama Bear, on the other hand, relied on a steady stream of income to fund her berry picking and honey hunting. Neither of these portfolios was wrong, they were just wrong for Goldilocks. She knew, as soon as she tasted the porridge, that hot and cold bowls were not for her.

Keep in mind that most of us don’t live in a fairytale world and could benefit from a guide to these decisions. One Vanguard study estimated that financial advisors can help clients earn an additional 3% from a combination of proper asset allocation, portfolio rebalancing, and coaching. There’s no need to wander around alone in the woods.

CORRECTION

We inadvertently misspoke in the last Perspective$ regarding the Medicare Advantage plans and the payment of premiums. With a Medicare Advantage plan, you must still pay premiums in the same way you do for traditional Medicare. As your income goes up and breaks through the threshold levels, the premiums go up as well. Additionally, if you have a Medicare Advantage plan that includes prescription drug coverage, the Part D premium and IRMAA also applies. We apologize for any confusion we may have created.

Recent Comments