WE WANT TO HEAR FROM YOU

We value your feedback! Help us improve your Perspective$ experience by sharing your thoughts in our brief survey. Your input will shape future editions and ensure we deliver content that resonates with you. Thanks in advance for your time.

ProVise Perspective$: Newsletter Feedback Survey (surveymonkey.com)

TAXES, TAXES, AND MORE TAXES

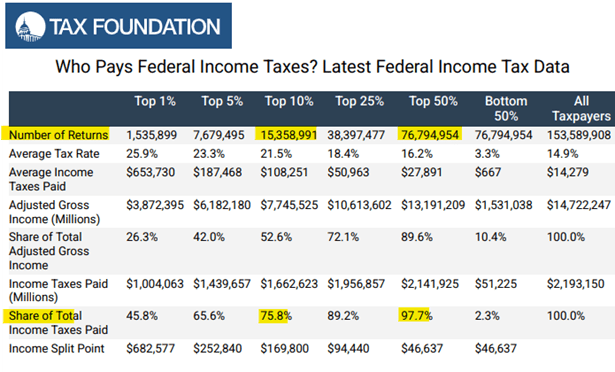

Americans pay two types of taxes, regressive and progressive. With a regressive tax, like a sales tax, the average tax burden decreases with income. Conversely, with a progressive tax, the more you make, the more you pay. Who pays the most in a progressive tax structure? The chart below illustrates federal income tax payments by tax rate. We offer it without comment.

WHAT’S BEHIND BITCOIN’S RALLY?

While many investments suffered losses in 2022, Bitcoin’s hemorrhaging was particularly acute. Falling 64% for the year, interest in the nascent cryptocurrency grew dim. As with other assets that rallied last year, Bitcoin made it all back and some. Since the end of 2022, Bitcoin is up over 300% and FOMO (fear of missing out) is in full force again. So, why the run? From a macroeconomic perspective, inflation is coming down and the prospect of lower interest rates is a boon for riskier investments like Bitcoin. On the regulatory front, several spot Bitcoin ETFs were approved by the SEC this January which makes it easier for investors to access the cryptocurrency and has increased demand. Bitcoin is up over 50% since then.

The other reason is a little more complex. Bitcoin’s supply is fixed and new coins are “mined” or unlocked as miners earn them by using expensive electronic equipment to verify transactions on the cryptocurrency’s blockchain. The blockchain refers to a decentralized network in which peer-to-peer transfers (cryptocurrency transactions) are recorded. It essentially takes the place of a centralized banking system. The rate at which miners can earn Bitcoin by performing this transaction verification process is reduced by approximately half every four years. This process, known as Bitcoin halving, reduces the speed of supply growth and supports the price of the cryptocurrency. The halving process will end once the number of Bitcoin in circulation reaches 21 million.

The next Bitcoin halving is expected to occur in April and if demand remains steady, this in theory should drive up the price. The question is, how much of this is already reflected in the price? This is impossible to answer if we do not know the intrinsic value of the asset. Unlike stocks and bonds, Bitcoin generates no income (dividends or interest) or earnings so the value is essentially whatever the next person is willing to pay for it. Whether the halving causes the price to increase or not cannot be explained by any quantifiable value creation. The merits of blockchain technology are undeniable across several industries, but the intrinsic value of related currencies is debatable.

EX-SPOUSE SOCIAL SECURITY BENEFITS

Social Security Divorced Spouse Benefits are federally funded and administered by the U.S. Social Security Administration. These benefits offer financial support to individuals who were married to someone eligible for Social Security benefits, but whose marriage ended in divorce. This program allows divorced spouses to claim benefits based on their ex-spouse’s work record. To qualify, you must meet these requirements:

- Be at least 62 years old and not currently married.

- Be divorced from a person who receives or is eligible to receive Social Security retirement or disability benefits.

- Have been married to that person for at least 10 years before the date the divorce became final.

- Not be entitled to an equal or higher retirement or disability benefit.

These benefits can be a vital source of income for divorced individuals who may not have built up substantial Social Security benefits based upon their own work record. By leveraging the work history of their former spouse, divorced individuals can help secure financial stability in their retirement years. It is important for those considering claiming these benefits to familiarize themselves with the eligibility requirements and consult with your financial advisor to understand how these benefits fit into your overall retirement strategy. Here is a great place to start to determine eligibility: Welcome to SSA BEST | SSABEST (benefits.gov)

Sources:

Welcome to SSA BEST | SSABEST (benefits.gov)

Benefits Planner: Retirement | Benefits For Your Family | SSA

Social Security Divorced Spouse Benefits | Benefits.gov

ARE YOU CHARITABLY INCLINED LIKE WARREN BUFFET?

Very few of us have the wealth of billionaire Warren Buffett but do you know what? Give what you can no matter how great or small. No one knows which dollar will cure Alzheimer’s, cancer or change the life of someone in need. Americans are among the most generous people in the world.

If you are charitably inclined, give to the charity or charities that are most meaningful to you. While giving away money can be very personally satisfying; it can also be tax favorable to you. You can do good for yourself while doing good for others. How the heck can you beat that combination?

At the most basic level, you can give good old-fashioned hard cash. If you are using a standard deduction for income taxes, then you are giving out of the goodness of your heart because you cannot deduct the contribution. If you itemize, then you can deduct up to 60% of your adjusted gross income (AGI). If you make $100,000, you can give up to $60,000 in cash and deduct the entire amount. If you cannot use the entire deduction in the year you donate to charity, then you can carry forward the unused portion for up to five years.

If you have appreciated property like stocks or real estate, by giving that property you can deduct 100% of the value, but you also avoid paying capital gains tax. Let us say you bought Newco stock for $10 a share and it is now worth $100. If you sell it, you will pay a capital gains tax and then have less to give to charity. But if you give the stock directly to the charity, you can deduct 100% of the stock’s value and avoid the capital gains tax. The limit you can deduct in any one year is up to 30% of your AGI with the unused portion carried forward for up to five years.

Another approach for appreciated assets is to set up a charitable remainder trust (CRT) which comes in two forms: annuity trust and unitrust. In an annuity trust, you will receive a guaranteed fixed amount each year that never changes. In a unitrust, however, it pays you a stated percentage each year based on the value of the trust and therefore, it can increase or decrease from year to year. Because you are retaining an interest in the CRT for your lifetime, or that of a joint beneficiary, you cannot deduct the entire contribution to the trust because you are retaining a future interest in the trust. At the death of the last beneficiary, the remainder is paid to the charity. Since the rules are complicated, we and most charities have software to help explain all the benefits of setting up a CRT.

Another possibility is to use a donor-advised fund (DAF). Some organizations, like a local Community Foundation and even Charles Schwab, make this vehicle available to donors and is often considered a “poor man/woman’s” family foundation. The same deductible rules apply to cash and appreciated assets. You can add to the DAF at any time in the future. The growth is tax-free each year. The donor, perhaps in combination with other family members, chooses the charities that will receive the money and there are no annual donation requirements from the DAF like a family foundation.

There are several other methods to do good for others while doing good for yourself. Working with our clients who are charitably inclined is one of the most satisfying aspects of being a financial planner. Not only do we see the joy in their eyes, but the warmth in their heart to help others. You should involve not only a financial planner, but an attorney and accountant. If you would like to learn more about charitable giving, please give us a call.

We hope you continue to stay safe and well.

Proudly and successfully serving our clients for over 38 years. As always, we encourage you to call or email us if you would like to discuss anything.

Recent Comments