Savvy Women Invest on Purpose

Preparing Your Investment Portfolio for a Volatile Election

Join ProVise President Eric Ebbert in a timely discussion about how to prepare your investment portfolio for a volatile presidential election.

Thursday, October 15th at 2:00 p.m.

Susan Washburn, CFP®, JD

Senior Financial Planner

My mission is to create an environment where you take ownership of your financial life while participating in a community that encourages, supports, educates and empowers you.

I lived a charmed life. Then, a hurricane changed it all.

As a young woman, I lived a charmed life. By thirty, I had a fabulous job, wonderful family and beautiful home in New Orleans. Then, two events derailed my life. Hurricane Katrina destroyed our home forcing us to evacuate and relocate to Florida. After spending several years rebuilding our lives, I finally felt settled only to be knocked off my feet by a divorce.

While I could not control the devastation of Hurricane Katrina, I could have better managed the financial chaos left by my divorce. Here, I was educated as a lawyer, working as a stay-at-home mom and I delegated my financial affairs leaving myself vulnerable, overwhelmed and embarrassed by my lack of financial knowledge. To regain my life, I needed to become smart about money and this journey led me to a career as a financial advisor.

As I shared my story with other women and clients, I was shocked by how many women are in the midst of their own financial hurricanes leaving themselves vulnerable. That is when I realized my true purpose as a financial adviser went far beyond simply managing their money. I began to inspire women to take more ownership in their financial lives. By encouraging women to face their fears and to get smarter about their relationship with money, they become confident, engaged and empowered in their financial futures.

CREATING FINANCIAL CONFIDENCE

Lifestyle Wealth Plan

BALANCED INVESTMENT STRATEGY

Where we delicately balance your desire for safety and income with your need for growth. By understanding the functions of your different investments, you will have a much clearer understanding about:

• What you have

• Why you have it

• How is it going to help you

JOIN OUR SAVVY WOMEN'S GROUP

Schedule a Complimentary Consultation

Financial planning is not one big thing…it is hundreds of little things™. We will walk with you every step of the way through investments, debt payoffs and everything in between to help you reach the financial goals that matter most to you.

STRAIGHT FROM THE SOURCE

Read our market analysis reports to stay up to date on the raw numbers that impact your financial landscape.

Maximizing Your Social Security Benefits: Why It’s Never Too Early to Plan for Retirement

Are you one of those people who shrug off the thought of Social Security because retirement seems light-years away? Think again. Planning for your Social Security benefits isn’t just a task for the golden years—it’s something you should be doing now. Let’s dive into why.

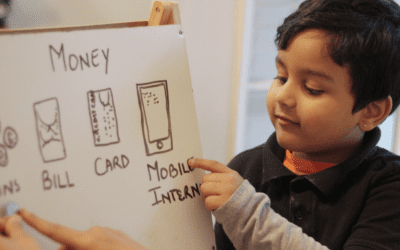

The Gift of Financial Literacy at Any Age

The holiday season is a time for comfort, joy, and celebration. As we gather with family and friends, it’s also the perfect time to have meaningful conversations with the ones we love. In a world driven by economic complexities, the importance of financial literacy cannot be overstated.

Protecting Generational Wealth: Key Tips for Securing a Lasting Legacy

Asset protection is one of the most important, if not the most important, financial planning areas for physicians. However, we’ve found that it isn’t a topic that gets enough coverage in the personal finance community and in today’s litigious environment, it is vital that you have an asset protection strategy.

- Home

- 404

- About Us

- Asset Protection

- Banking and New Proposed Taxes Webinar – March 20, 2023

- Blueprint sections 2

- Bullet Disclaimer

- Business Owners

- Careers

- Clearwater

- Client Center

- Complimentary Consultation

- Confidential Income Expense Worksheet

- Contact Us

- Daniel-Mannix

- Debbi Darchi

- Designation Disclosure

- Environmental, Social and Governance

- Eric R. Ebbert

- Estate and Trust Planning

- Evelyn Sheridan

- Events

- Financial Planning

- Financial Planning 2

- Financial planning for professionals

- Form ADV

- Form Test page

- Four Ways Doctors Can Save on Taxes

- Four Ways Doctors Can Save on Taxes – Download

- Helpful Resources

- Holly Harman

- Hurricane Info

- IMPORTANT DISCLOSURE INFORMATION

- In the Community

- Income Expense Worksheet Form

- Independent Women

- Jon Brethauer

- Kimberly Adams-DiPiero

- Managed Client Form

- Nancy Croy

- New Client Forms

- News & Insights

- Oscar-Skjaerpe

- Our Team

- Paul H. Auslander

- Personal Financial Officer

- Peter Seriano CFP

- Philanthropy & Charitable Giving

- Physicians

- Planning Disclosure

- Privacy Policy

- ProVise Planning Experience

- Provise Planning Graphic

- Ready To Retire

- Recognition

- Recognition Disclosure

- Retiree

- Retirement Plan Consulting

- Retirement Planning

- Retirement Readiness Survey

- Review of 2022 and Secure 2.0 Act Webinar

- Russell Campbell

- Sandy Risgaard

- Savvy Events

- Shane O’Hara

- Social Security Webinar – February 22, 2023

- Steve Csenge

- Subscribe to ProVise Perspective$

- Susan Washburn

- Thank You – Calendly

- Thank You – Consultation

- Thank You For Contacting Us

- Thank You Planning Packet

- Thanks for Subscribing

- V Raymond Ferrara, CFP®

- Wealth Management

- Who We Serve

- Tampa #2