Who We Serve

No matter your age or station in life

We are here to serve you with a team of well-credentialed financial planners and staff. But at our first meeting, don’t be surprised if the last thing we ask about is your financial status. It is important for us to first know you as a person and to understand the issues that brought you to seek our advice. Our financial planners in Tampa and Clearwater work with clients undergoing all phases of life.

Consider the financial plan we develop for a recently married couple. Now think about how that plan may change with the birth of a child. There are new tax implications, college funds, potentially a larger house to purchase, and so much more. That same couple may also own a rapidly expanding business that provides a 401(k) to its employees.

As the couple ages, new milestones continue to appear. Grown children may return home after college, the couple’s own elderly parents may need prominent care, and there may be a shift to wealth management to preserve what’s been built and protect the couple’s assets. Then there is the day that the paycheck stops and retirement arrives. Planning for this event starts well before one reaches a lifetime of leisure and our team can help with your retirement planning from the very beginning of our relationship. Need to update your estate plan? Want to give to your favorite charities? We will work with your tax and legal advisors to structure these important matters as well.

These are all real-life examples of the types of clients we work with daily. In fact, we serve more than 1,000 families in over 30 states, each with different goals, objectives, needs and financial resources. As you can see our well credentialed financial planners in Tampa and Clearwater work with clients no matter their life circumstances.

Through our complimentary first meeting, together we can jointly determine if ProVise is the right firm to assist you.

What to expect in a complimentary consultation

A 30-minute complimentary consultation with ProVise Management Group is different from what you may have experienced with other financial planners. In this meeting, you'll speak with a CERTIFIED FINANCIAL PLANNER™.

We want to know more about your goals and place in life than how much money you have in your accounts.

We would be happy to meet you in person at our Clearwater and Tampa offices or schedule a Zoom call.

Here’s a quick snapshot of how our consultation works:

Step 1

What prompted you to contact us?

Is it a new job with a complex compensation plan, the formation of a new business, a birthday that makes retirement feel more imminent, an inheritance, the death of a spouse or another event?

Step 2

What are your goals?

We'll discuss your objectives for your finances and retirement and diagnose any potential issues that may be keeping you from reaching your goals.

Step 3

Here's how we can help

We’ll tell you about us and how we work, including the services we offer and our fee structure. Then, we’ll give you the time and space you need to decide if you want to work with us—and when you’re ready, so are we.

The ProVise Planning Experience

A financial plan is a roadmap to your financial success. A ProVise financial planner will follow a process that includes the following steps to creating a customized strategy specific to your current financial situation, lifestyle, and future goals.

1. Understanding Your Personal and Financial Circumstances

Before we can help you reach your goals, we need to understand where you are. We perform a thorough analysis of your current financial situation and upcoming risks before creating a financial plan designed for your increased future success.

2. Identifying and Selecting your goals

Your future financial goals will dictate your current financial choices. We need to understand your goals and then help you prioritize those goals, so we can align your financial strategy with the lifestyle for which you are aiming. We help you balance your goals in a way that is designed to benefit your current lifestyle without neglecting your future financial goals

3. Analyzing Your Current Course of Action and Potential Alternative Courses of Action

It is important for us to first determine what you are currently doing and why. What is your approach to your finances and investments? There is no reason to seek alternatives if what you are doing is working. However, we can only do this in the context of looking at alternatives that may either fine tune what you are doing, or perhaps offer an alternative approach.

4. Developing the Financial Planning Recommendation(s)

Unlike others who just want to sell you something that may not be in your best interest, we do not consider recommendations until we have taken the first three steps of the financial planning process. You do not want a physician to create a treatment plan without a thorough analysis of your current condition and consideration of alternatives. The same is true with your financial health.

5. Presenting the Financial Planning Recommendation(s)

We will provide you with a set of written recommendations sharing our best ideas and thoughts regarding your personal financial situation. For those with a relatively uncomplicated financial life it might be done in a bullet point format, while for others it could be a much longer document. It might even be done with a modular plan focusing on the one aspect that is most concerning to you.

6. Implementing the Financial Planning Recommendation(s)

We help you put the financial planning strategy to work by putting together a checklist of action items for you and us that helps ensure that the plan is implemented in a timely fashion. There is nothing worse than knowing what needs to be done and then not doing it.

7. Monitoring the Progress and Update

Financial planning is not an event that happens one time. It is a continuous process. Life happens and things change. You will not go it alone. We will walk with you through every financial decision, roadblock, obstacle and opportunity to make sure you are staying on track toward your financial goals.

Schedule a Complimentary Consultation

Financial planning is not one big thing…it is hundreds of little things™. We will walk with you every step of the way through investments, debt payoffs and everything in between to help you reach the financial goals that matter most to you.

STRAIGHT FROM THE SOURCE

Read our market analysis reports to stay up to date on the raw numbers that impact your financial landscape.

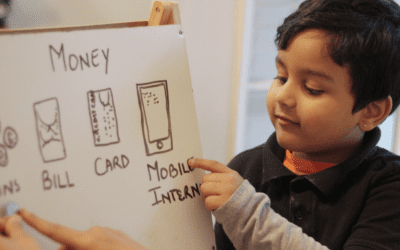

The Gift of Financial Literacy at Any Age

The holiday season is a time for comfort, joy, and celebration. As we gather with family and friends, it’s also the perfect time to have meaningful conversations with the ones we love. In a world driven by economic complexities, the importance of financial literacy cannot be overstated.

Protecting Generational Wealth: Key Tips for Securing a Lasting Legacy

Asset protection is one of the most important, if not the most important, financial planning areas for physicians. However, we’ve found that it isn’t a topic that gets enough coverage in the personal finance community and in today’s litigious environment, it is vital that you have an asset protection strategy.

Health Care Costs in Retirement: The Role of Medicare

As retirement approaches, many individuals embark on a journey to secure their financial well-being and health for the future. One critical aspect of this journey is navigating the complex landscape of healthcare and healthcare costs in retirement. Because Medicare plays a significant role, it’s crucial to understand its many aspects.

- Home

- 404

- About Us

- Asset Protection

- Banking and New Proposed Taxes Webinar – March 20, 2023

- Blueprint sections 2

- Bullet Disclaimer

- Business Owners

- Careers

- Clearwater

- Client Center

- Complimentary Consultation

- Confidential Income Expense Worksheet

- Contact Us

- Daniel-Mannix

- Debbi Darchi

- Designation Disclosure

- Environmental, Social and Governance

- Eric R. Ebbert

- Estate and Trust Planning

- Evelyn Sheridan

- Events

- Financial Planning

- Financial Planning 2

- Financial planning for professionals

- Form ADV

- Form Test page

- Four Ways Doctors Can Save on Taxes

- Four Ways Doctors Can Save on Taxes – Download

- Helpful Resources

- Holly Harman

- Hurricane Info

- IMPORTANT DISCLOSURE INFORMATION

- In the Community

- Income Expense Worksheet Form

- Independent Women

- Jon Brethauer

- Kimberly Adams-DiPiero

- Managed Client Form

- Nancy Croy

- New Client Forms

- News & Insights

- Oscar-Skjaerpe

- Our Team

- Paul H. Auslander

- Personal Financial Officer

- Peter Seriano CFP

- Philanthropy & Charitable Giving

- Physicians

- Planning Disclosure

- Privacy Policy

- ProVise Planning Experience

- Provise Planning Graphic

- Ready To Retire

- Recognition

- Recognition Disclosure

- Retiree

- Retirement Plan Consulting

- Retirement Planning

- Retirement Readiness Survey

- Review of 2022 and Secure 2.0 Act Webinar

- Russell Campbell

- Sandy Risgaard

- Savvy Events

- Shane O’Hara

- Social Security Webinar – February 22, 2023

- Steve Csenge

- Subscribe to ProVise Perspective$

- Susan Washburn

- Thank You – Calendly

- Thank You – Consultation

- Thank You For Contacting Us

- Thank You Planning Packet

- Thanks for Subscribing

- V Raymond Ferrara, CFP®

- Wealth Management

- Who We Serve

- Tampa #2