OVER $1 TRILLION IN CREDIT CARD DEBT

For the first time, the New York Fed has reported that credit card debt exceeded $1 trillion with the talking heads predicting a doomsday scenario. Then twenty-four hours later they forgot the story. Today, with more people working and with more credit cards than ever before, the debt is going to naturally be higher too.

But the real story is not the debt itself. First, savings accounts are higher and probably not earning more than 2%. Credit card interest rates have increased with the rise in interest rates over the past 16 months and now top out at about 22%.

At that rate of interest, it is very hard to eliminate the balance. We think the bedrock of any financial plan is to have an emergency and opportunity fund that has at least three months’ worth of household expenses. Why in the world are people keeping money in savings at 2% while they are paying 20-22% in interest on their credit card debt? The psychology of this phenomenon is simple. Money in the bank makes us feel good and it gives us confidence to spend more. But this is a false feeling that is VERY expensive. There are very few guarantees when it comes to money and investing, but you are guaranteed to save/earn 20% by using those savings dollars to pay off those credit cards. You may not feel as confident, but financially you will be MUCH better off.

STUDENT LOAN REPAYMENTS START NEXT MONTH AND 62% SAY “NO!”

At the beginning of the pandemic almost 3½ years ago, the government suspended student loan repayments meaning no principal payments, no additional interest, and no penalties. Beginning in October, payments will need to be made again.

President Biden introduced a plan to forgive up to $10,000 student loan debt for most and another $10,000 for many others. The United States Supreme Court ruled that only Congress has the power to forgive the loans. The President then introduced another forgiveness plan to help those who have been making payments for 20 years or more. This plan is also being challenged in the courts. Intelligent.com, a think tank group for education, surveyed 1,000 people with a student loan. They found: 1) 62% intend to “boycott” making payments because they think it will lead to forgiveness of their loans; 2) 72% who plan on starting payments say they will have to get an additional job to make the payments; and 3) 75% say they will be swayed towards political candidates that favor loan forgiveness. “Boycott” seems to mean they will make no payments and thinking that this strategy will lead to forgiveness seems to be naïve and wishful thinking. We are not surprised that many will vote for candidates willing to give money away free and/or forgive debt… it seems to be the new mentality of many in America today.

OMG! 14 MONTHS UNTIL ELECTIONS

Would you believe that our next presidential election is only 14 months away? Like every previous election, the state of the economy and financial markets will be a hot topic of debate among voters and candidates alike. But how do the markets perform in the year of a Presidential election? How will it impact market performance for the rest of their term?

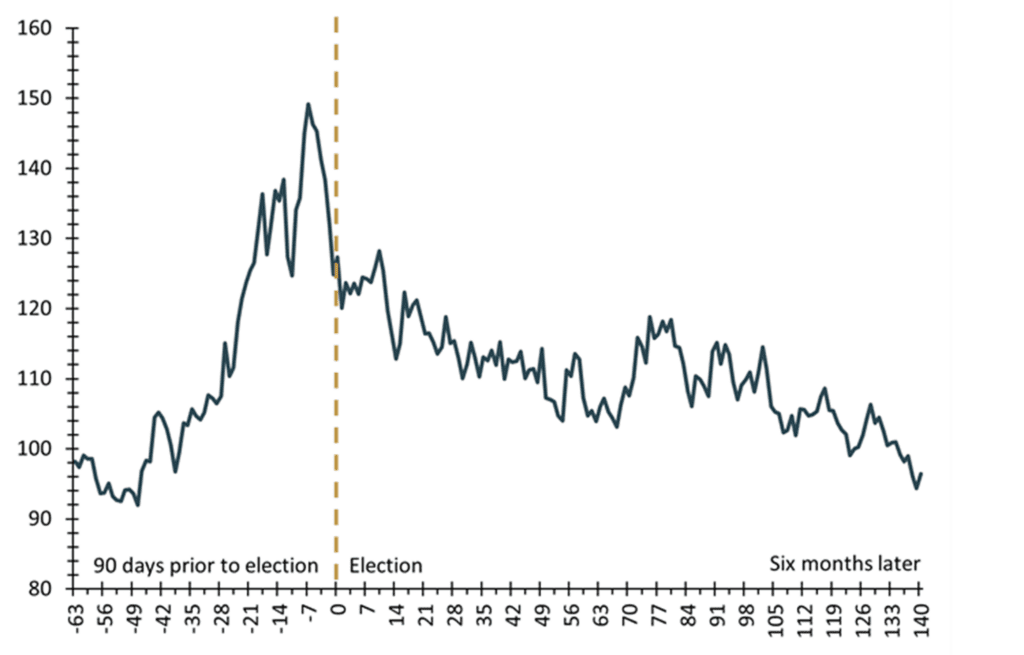

It likely won’t be a surprise to learn that markets tend to be more volatile in the months preceding a presidential election. Voters vote first with their pocketbook in mind. As the two main candidates battle for votes with competing visions of the country, investors grapple with how each candidate’s vision will impact the economy and various businesses. As such, day-to-day swings in stock prices tend to be elevated. One measure of volatility, known as the VIX, has climbed 30% in the 90 days leading up to election day, on average since 1992.

Once the election happens – and often even before election day – volatility quickly subsides, continuing a downward trajectory for the next six months only to end pretty much where it began.

Past performance is not a reliable indicator of current or future results. Indexes are unmanaged and not subject to fees. It is not possible to invest directly in an index. Source: Kestra Investment Management with data from FactSet. Index proxies: CBOE Market Volatility Index. Data as of August 14, 2023.

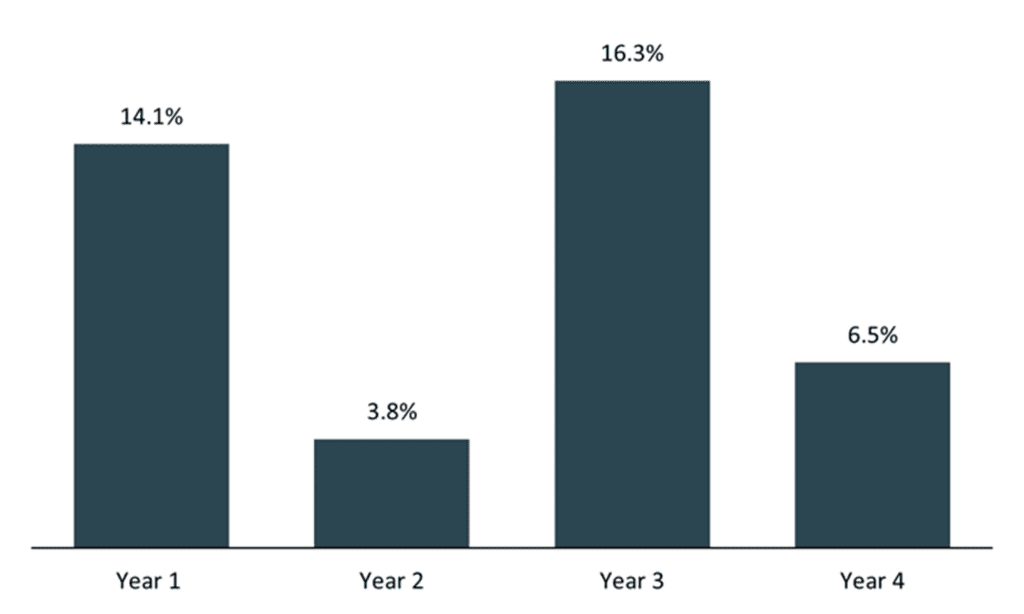

In addition to changes in volatility, stocks also tend to follow a discernable pattern. While there are notable exceptions, the third year of a president’s term tends to be the best for stocks, which would correspond to this year, the third of President Joe Biden’s presidential term. Having said that, President Biden’s first year (2021) looks to be the best so far.

One theory for this positive performance is that the party in power spends more before an election, driving economic growth and stocks in the process, all in the hopes of helping its candidate at the polls the following year. Note that this pattern of strong stock performance in the third year holds true for both Republican and Democratic administrations.

Average S&P 500 Index Total Returns After Election Years 1976-2023

Past performance is not a reliable indicator of current or future results. Indexes are unmanaged and not subject to fees. It is not possible to invest directly in an index. Source: Kestra Investment Management with data from FactSet. Index proxies: S&P 500 Index. Data as of August 14, 2023.

While there are some discernable patterns around presidential elections, politics tends to have a fleeting impact on long-term stock performance. Remember, the stock market historically delivers positive returns over time. Professor Jeremy Siegel, author of the 1994 investment classic Stocks For The Long Run, put it succinctly: “Bull markets and bear markets come and go, and it’s more to do with business cycles than presidents.”

It is the time you are in the market, not the time you are out of it, nor the party that is in power over time that makes a difference.

WHEN DID YOU LAST CONSIDER YOUR ESTATE PLAN?

Creating an estate plan is not usually a one and done process. Why?

- Tax law changes.

- New beneficiaries join the family, and older ones pass away.

- Financial fortunes come and go.

- Marriages don’t always last and maybe a new one occurs.

- Charities may fall out of favor only to be replaced by new ones.

- Family dynamics.

In short, when did you last review your estate plan? Estate planning is not just for the elderly. Let’s start with the five basics.

- Will

- Potentially a Living Trust

- Durable Power of Attorney

- Health Care Surrogate

- Living Will

Who will you name as s your personal representative in your will, the successor trustee of your living trust, your attorney in fact, and surrogate for healthcare decisions if you are unable to make them yourself? Were the documents done while you still had underage children or before grandchildren? Has your wealth increased/deceased significantly? Have you (re)married?

Then there is the matter of named beneficiaries on life insurance (personal and group plans), annuities, bank accounts, and retirement plans, including IRAs and corporate plans. Do you have contingent beneficiaries named in the event the primary beneficiary pre-deceases you? When did you last get a copy of all beneficiary forms to verify everything?

What plans have you made, if any, for asset protection for not only a lawsuit, but in the event of being placed into a long-term care facility? What estate tax and/or inheritance tax will be owed? How will they be paid? Do you have an irrevocable trust? What are your thoughts about charitable contributions at death and what are the best assets to be given to charity? Do you have a life insurance policy that you have had for years, but don’t need anymore?

If it has been more than five years since you looked at your estate plan, it is time to review it, especially considering the changes coming in 2026 unless Congress changes the laws. The process will involve a team of advisors. Your financial planner, attorney, and CPA at a minimum. Why not set an appointment with us to help start the review process?

SOCIAL SECURITY INCREASE STILL AT 3%

About two months ago, we reported that the initial estimate for an increase in Social Security benefits was 3%. In its most recent report, the Senior Citizens League is reaffirming that guidance. The index that is used by Social Security increased 0.2% in July which brings the year-over-year increase to 2.6%. At 3% the average benefit of about $1,800 would increase by $54 monthly. The final benefit projection will be next month.

INDEX ANNUITY ILLUSTRATIONS QUESTIONED

It is no secret that we are not big fans of Index Annuities for most people and have been concerned about these products being pushed so hard by insurance companies and agents. Make no mistake, these products are complicated and complex. Sunday morning TV shows are filled with people hawking these products. They are pitched at lunch and dinner seminars across the country, and it isn’t unusual to get invitations twice a week. A great way to save on food, but purchasing one of these products can be an expensive proposition in the long run. After researching this product, Morningstar expressed their concerns about some of the illustrations being used to sell the product to the National Association of Insurance Commissioners. Without going into a lot of technical detail here, we urge anyone who is considering one of these products, or knows someone who is, to seek a second opinion with us or some other fiduciary firm before moving forward.

TAMPA: A GULF COAST GEM ATTRACTING MILLENNIALS AND GEN ZERS

Despite ranking 4th in the U.S. News & World Report’s “2022-2023 Best Places to Retire in the United States, the Gulf Coast city of Tampa has unexpectedly captured the attention of Millennials and Gen Zers. The city’s unique blend of business and leisure has earned it one of the Top 10 U.S. cities that Millennials and Gen Zers flock to according to the FinTech company, SmartAsset.i

Tampa’s spot on the recent Top 10 cities can be attributed to its ever-evolving urban oasis. The city of Tampa’s newest three phase development project, totaling over $3 billion, has captured the heart of the city’s younger residents. Water Street serves as a blend of business and leisure with luxury hotels, upscale shopping, and dining. Within walking distance to the home of the Tampa Bay Lightning and Michelin-starred restaurants such as Lilac, located in the Marriott International’s Edition hotel, Water Street has become a vessel for young professionals.

Outside the booming downtown districts, Tampa’s historic neighborhoods such as Hyde Park and Ybor City, provide a dose of southern charm. With charming bungalows and the shade of great oak trees, Hyde Park’s Historic District has become one of the most prominent areas in South Tampa. Whether you are looking for a luxurious dining experience on Snow Avenue, checking out the unique boutiques, or taking a stroll down the uninterrupted 4.2 miles of Bay Shore Boulevard, Hyde Park offers it all.

The city of Tampa’s unexpected blend of culture, adventure, and culinary delights is reinventing the Gulf Coast experience. Gen Zers and Millennials are reminding us to keep our eyes on Florida’s West Coast Gem.

We Hope You Continue to Stay Safe and Well

Proudly and successfully serving our clients for over 37 years. As always, we encourage you to call or email us if you would like to discuss anything.

Recent Comments