Environmental, Social and Governance (ESG)

Enter the Environmental, Social and Governance (ESG) criteria. The ESG criteria assesses the impact of a company on the environment, a company’s role in social justice and equality and a company’s ethical standard in how it treats its employees and clients.

Each year, major financial institutions like JPMorgan, Wells Fargo, Goldman Sachs and Chase publish reports that analyze the ESG standards of many companies with investment and stock options.

Request Your Complimentary Consultation from a CFP® Professional

How ESG affects investors

CFPs are financial professionals who can help you determine how to invest your finances in companies that meet the ESG criteria that align with your values.

CFPs have achieved their certification by meeting the rigorous standards of financial planning professionalism while adhering to ethical standards. So, when it comes to making a financial decision regarding an investment that aligns with your ethics and values, a CFP is exactly the type of financial professional you can trust.

How ESG affects businesses

Understanding each part of ESG

The “Environmental” part of ESG

Companies that meet the environmental criteria of ESG demonstrate that they take measures to reduce their risks of harming the environment. When assessing a company’s environmental criteria, financial institutions consider the amount of energy a company uses, how much waste and pollution it generates and how it treats plants and wildlife.

The “Social” part of ESG

Companies that meet the social criteria of ESG demonstrate that they take measures to value human life and are respectful toward other businesses and the community. When assessing a company’s social criteria, financial institutions look at a company’s diversity, its stance on human rights, how it values the consumer and how it interacts with the community and other businesses.

The “Governance” part of ESG

Companies that meet the governance criteria of ESG demonstrate that they operate within well-rounded ethical standards. When considering a company’s governance criteria, financial institutions look at how a company treats its employees, its stakeholders and its clients. Companies that treat all of these people well are considered to meet the governance criteria of ESG.

Do you need help making an investment decision based on ESG? Or does your company need to improve its ESG-related standards? It’s time to talk to a CFP at ProVise Management Group

We work hard to develop a personalized financial plan that works best for you or your business without sacrificing your values. We provide this plan at a fiduciary standard of care and offer an unconditional money back guarantee if you are not satisfied with it. If for any reason you are not satisfied with the written plan, simply return it to us and we will refund 100% of the fee paid. Once presented and accepted, we will create an implementation strategy and then establish a monitoring system that meets your needs.

Whether you’re an investor who’s looking for opportunities to invest in a business that reflects your ethical values or if you work for a business that’s looking to improve its ESG compliance, our CFP are ready to help.

Schedule a Complimentary Consultation

Financial planning is not one big thing…it is hundreds of little things™. We will walk with you every step of the way through investments, debt payoffs and everything in between to help you reach the financial goals that matter most to you.

STRAIGHT FROM THE SOURCE

Read our market analysis reports to stay up to date on the raw numbers that impact your financial landscape.

Maximizing Your Social Security Benefits: Why It’s Never Too Early to Plan for Retirement

Are you one of those people who shrug off the thought of Social Security because retirement seems light-years away? Think again. Planning for your Social Security benefits isn’t just a task for the golden years—it’s something you should be doing now. Let’s dive into why.

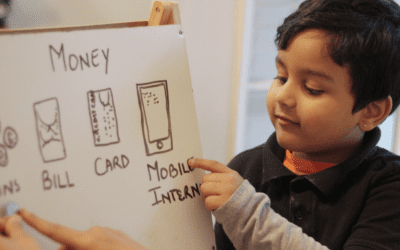

The Gift of Financial Literacy at Any Age

The holiday season is a time for comfort, joy, and celebration. As we gather with family and friends, it’s also the perfect time to have meaningful conversations with the ones we love. In a world driven by economic complexities, the importance of financial literacy cannot be overstated.

Protecting Generational Wealth: Key Tips for Securing a Lasting Legacy

Asset protection is one of the most important, if not the most important, financial planning areas for physicians. However, we’ve found that it isn’t a topic that gets enough coverage in the personal finance community and in today’s litigious environment, it is vital that you have an asset protection strategy.

- Home

- 404

- About Us

- Asset Protection

- Banking and New Proposed Taxes Webinar – March 20, 2023

- Blueprint sections 2

- Bullet Disclaimer

- Business Owners

- Careers

- Clearwater

- Client Center

- Complimentary Consultation

- Confidential Income Expense Worksheet

- Contact Us

- Daniel-Mannix

- Debbi Darchi

- Designation Disclosure

- Environmental, Social and Governance

- Eric R. Ebbert

- Estate and Trust Planning

- Evelyn Sheridan

- Events

- Financial Planning

- Financial Planning 2

- Financial planning for professionals

- Form ADV

- Form Test page

- Four Ways Doctors Can Save on Taxes

- Four Ways Doctors Can Save on Taxes – Download

- Helpful Resources

- Holly Harman

- Hurricane Info

- IMPORTANT DISCLOSURE INFORMATION

- In the Community

- Income Expense Worksheet Form

- Independent Women

- Jon Brethauer

- Kimberly Adams-DiPiero

- Managed Client Form

- Nancy Croy

- New Client Forms

- News & Insights

- Oscar-Skjaerpe

- Our Team

- Paul H. Auslander

- Personal Financial Officer

- Peter Seriano CFP

- Philanthropy & Charitable Giving

- Physicians

- Planning Disclosure

- Privacy Policy

- ProVise Planning Experience

- Provise Planning Graphic

- Ready To Retire

- Recognition

- Recognition Disclosure

- Retiree

- Retirement Plan Consulting

- Retirement Planning

- Retirement Readiness Survey

- Review of 2022 and Secure 2.0 Act Webinar

- Russell Campbell

- Sandy Risgaard

- Savvy Events

- Shane O’Hara

- Social Security Webinar – February 22, 2023

- Steve Csenge

- Subscribe to ProVise Perspective$

- Susan Washburn

- Thank You – Calendly

- Thank You – Consultation

- Thank You For Contacting Us

- Thank You Planning Packet

- Thanks for Subscribing

- V Raymond Ferrara, CFP®

- Wealth Management

- Who We Serve

- Tampa #2