TAX TIME AND THOSE RED FLAGS

As you prepare your 2023 taxes, you may be wondering what the IRS is watching carefully for potential audits, especially on those with high incomes. Given the extra funding provided by Congress, the IRS is hiring more examiners. While not an exhaustive list, here are a few IRS red flags: large partnership returns; foreign assets; large deductions that seem outside guidelines given one’s income; digital assets; sole proprietors filing Schedule C; investment basis; material participation; and non-cash charitable contributions.

WHAT DOES A PRESIDENTIAL ELECTION MEAN TO INVESTORS?

One month into the new year, and one thing is for certain: The presidential election will continue to grab headlines and grip the nation’s attention. How might this impact investors in terms of perceptions and actual market performance? We will explore these questions by using historical data.

Election Angst

It’s no secret that presidential elections are a source of anxiety for many investors, and that’s understandable.

For starters, headlines exacerbate concerns over perceived market volatility. And, given the potential for turnover in the White House and/or Congress, presidential elections raise the level of uncertainty around issues of national importance, including government policy on individual and corporate taxes, and/or industry regulation. As we’ve seen in recent years, government policy can have a big impact on such critical sectors as healthcare and infrastructure, creating winners and losers.

As media coverage intensifies, presidential elections also shine a spotlight on our collective pain points as a nation, from kitchen-table issues to geopolitical concerns. Indeed, inflation and conflict in the Middle East and Ukraine will be among the issues dominating the conversation this election cycle.

Taxes — in particular the Trump-era tax cuts that are set to expire next year – are likely to be a focal point too. And given the large amount of U.S. debt coming due in today’s higher-rate environment, government debt and spending are likely to be talking points as well.

Source: iCapital

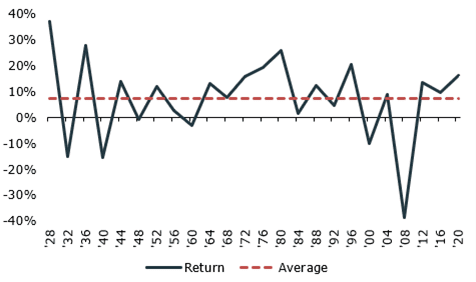

Off to the Races

Interestingly, out of all four years of each presidency dating back to 1930, the S&P 500 typically performed best in the third year, posting a median price return, excluding dividends, of about 18%. In Biden’s third year of his term, the S&P 500 was up 24%.

The Finish Line

So, how has the market performed in the final stretch of the presidential elections and the immediate aftermath? Overall, better than we might expect.

- For the 60-day period leading up to Election Day, the market has tended to be relatively flat, posting a median price return of 1.7% since 1930. But the S&P 500 finished in positive territory two-thirds of the time. This is not too surprising given the uncertainty before the election.

- For the 60-day period following Election Day, the market has tended to rise modestly, posting a median price return of 3.2%. Decreased uncertainty around the policy priorities of the incoming administration (whether new or re-elected) has likely been a contributing factor. Once again, the market finished in positive territory two-thirds of the time for the 60-day post-election period dating back to 1930.

Presidential elections can certainly contribute to market volatility. And, in fact, during the first six months of an election year, we tend to see an uptick in volatility. The good news is that most of the time the market has ended the year on a positive note. Since 1928, the median price return for the full year of a presidential election year was nearly 11%. And the market finished higher three quarters of the time.

Returns During Presidential Election Years

Source: Kestra Investment Management with data from FactSet

Keep Fundamentals in Focus

While headlines may cause investors to worry, we can take some comfort in the fact that historical data going back nearly a century reveals that the market tends to come out ahead much of the time in presidential election years.

This was certainly the case with the previous Biden-Trump matchup in 2020, although that election took place against the backdrop of the pandemic and the historic government stimulus measures enacted in response to the crisis.

After a steep decline followed by a strong recovery in the first half of 2020, the market saw renewed volatility in the late summer and early fall. By the time Election Day rolled around, the market was in the midst of another rally. It ultimately finished the year with a price gain of more than 16%. Anyone who waited to invest until after the election had passed missed a good portion of the year-end rally.

As with other events that can contribute to short-term market fluctuations, presidential elections should not factor into asset-allocation decisions or lead to rushed decision-making. Fundamentals, such as the business cycle and other economic variables, remain the primary drivers of returns during election years. As always, investors should remain disciplined and diversified.

WHAT IS A CeFT®?

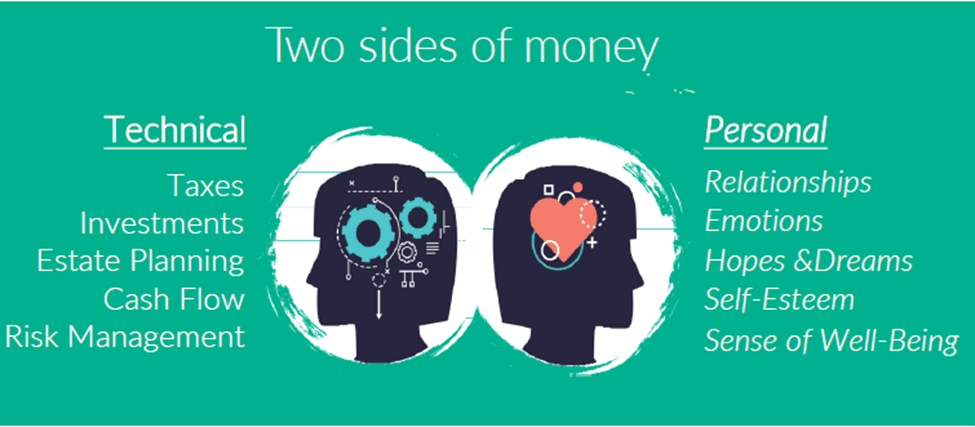

ProVise Senior Financial Planner, Susan Washburn, completed her year-long core training and exam to be recognized as a Certified Financial Transitionist®. What is a Certified Financial Transitionist®?

This training complements Susan’s financial knowledge by focusing on the personal-side skills clients need as they face major life events like divorce, death, inheritance, retirement, or a sudden windfall of money. In these times of transition, the CeFT® can help clients as they struggle with emotions, anxiety, communication, decision-making, and self-care.

As the founder of the program, Susan Bradley puts it: “When life changes, money changes. And when the money changes, life changes.“ If you know anyone who needs both the technical skills as well the personal skills during a major life event, reach out to Susan at washburn@provise.com for financial transition planning.

Source: Financial Transitionist® Institute

THE NEW MEMBER OF THE DIVIDEND CLUB — META

Earlier this month, Meta became another member of the dividend club when it announced that it would start paying $0.50 per share of their outstanding common stock to their shareholders. The first quarterly dividend payment is set to be sent out on March 26, 2024. To receive the dividend payment, you’ll need to own Meta shares before their ex-dividend date of 2/21/24. Meta also authorized a $50 billion buyback of their shares. This, along with the prospect of dividend payments, pushed the Meta stock price to new all-time highs.

So, are these recent announcements a way to appease shareholders or a positive outlook on the company’s future? Most people see this as a positive sign that Meta will be able to maintain their profits and growth trajectory. Others may argue that once a company starts paying dividends, growth rates slow down. However, companies like Apple and Microsoft have defied this trend. We’ll have to wait and see if Meta can continue their streak of innovation and growth or if they are on their way to becoming another cash cow.

Meta Joined the Dividend Club. Are Its Stock’s Best Days Behind It? – WSJ

Meta – Meta Reports Fourth Quarter and Full Year 2023 Results; Initiates Quarterly Dividend (fb.com)

SOCIAL SECURITY’S SECURITY IS JUST AROUND THE CORNER…NOT

Representative Angie Craig (D-MN) proposed a bill, “You Earned It, You Keep It,” to eliminate taxation of Social Security benefits for all retirees. She argues that it is unfair to double tax these benefits since Social Security taxes were paid on earning from all workers. Up to 85% can be taxed if a couple’s joint adjusted income exceeds $44,000 or an individual’s income exceeds $34,000.

What she fails to understand is that Social Security recipients today are not getting their own money back but are receiving earned income that is being taxed today. In addition, the amount a Social Security beneficiary receives over an average lifetime far exceeds all that he/she contributed while working. She would replace the lost tax income with an additional tax on those who earn over $250,000 to sustain the Social Security Trust Fund significantly. This was confirmed by Stephen Goss, the Chief Actuary for Social Security, when he sent Representative Craig a letter that stated it would extend the Trust Fund for an additional 20 years. The bill was sent to committee, but who knows if it will get a hearing while Republicans control the House.

MEDICAL COSTS IN RETIREMENT

The Employee Research Benefit Institute (ERBI) has recalculated the costs of medical care in retirement. These costs include insurance premiums for Medicare, Medicare Advantage and supplements, deductibles, co-pays, and prescription drugs. Often, retirees overlook this significant expense. To have a 90% chance of having enough saved for these medical expenses, ERBI estimates that a couple will spend $351,000, a single man will spend $184,000, and a single woman $217,000.

We hope you continue to stay safe and well.

Proudly and successfully serving our clients for over 38 years. As always, we encourage you to call or email us if you would like to discuss anything.

Recent Comments