WE WANT TO HEAR FROM YOU

We value your feedback! Help us improve your Perspective$ experience by sharing your thoughts in our brief survey. Your input will shape future editions and ensure we deliver content that resonates with you. Thanks in advance for your time.

ProVise Perspective$: Newsletter Feedback Survey (surveymonkey.com)

NANCY CROY RAMEY RETIRES

It is with mixed emotions that we announce Nancy Ramey’s retirement after 24 years with ProVise. She will be sorely missed but she is ready to adjust her schedule and enjoy this new chapter of life. She plans to travel and see new places…and play more golf, too. Please join us in congratulating her on her much-deserved retirement. We cannot begin to express how much she has meant to ProVise and all the clients she has served. We wish her Happy unexpected discoveries – Happy creative adventures – in this Happy new phase of her life!

WHERE ARE INTEREST RATES HEADED – DOWN, BUT WHEN?

At the beginning of the year, many thought that the Fed would begin reducing interest rates at its March meeting and then they would do it again five more times in 2024. However, we have consistently said, that the first-rate cut was not likely before June and then maybe one or two more before the end of the year.

Last week Chair Powell made it very clear to Congress that while things have improved on the inflation battle, it was still too early to declare victory. He commented that rates would start to decline when the Fed was convinced that inflation was sustainably on its way to the Fed’s target of 2%. The important thing about his statement is that inflation doesn’t have to get to 2% before they start cutting. But how far might they go? Back to almost zero? We think not.

Getting to that level is dangerous in many ways. First, many folks that are trying to save cash don’t want to be paid nothing for it again. Next, if we go back there with the economy in good shape and things go sour, the Fed would have virtually no arrows to use to help us stimulate the economy and get out of a recession. We were lucky the last time, but let’s not press it. But do we need to go back there to have a strong and sustainable economy? The answer is…NO!

During every decade over the last 60 years, with rates ranging from just under 4% to start the 60’s to 15% in ‘80s to under 2% just a few years ago, our country’s Gross Domestic Product grew over double digits.

THE GREAT WEALTH TRANSFER IS HAPPENING!

Ellevest published its 2024 Women & Wealth Survey focusing on the great wealth transfer. Baby boomers (those born between 1946 and 1964) are transferring wealth that they have built during their lifetime.

Cerulli Associates anticipates that $84 trillion will be transferred to heirs and charities over the next 20 years.[i] Often, the path follows husbands who pass the wealth to their wives (women tend to live longer) and then to the next generation either to their children or to charities.

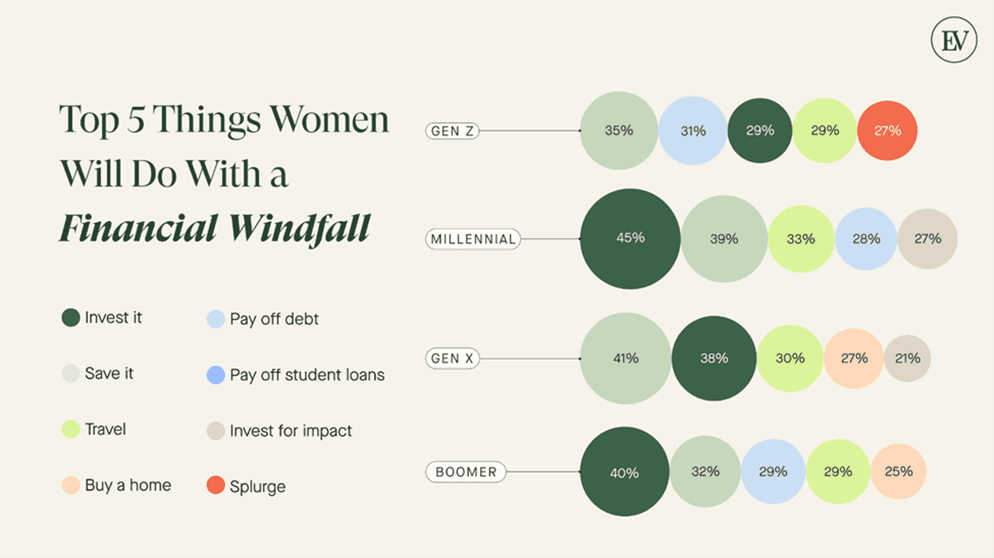

Ellevest asked different generations of women “What will women do with their financial windfalls?” Here are how the different generations planned on using these funds.[ii]

Just in case you need a reminder:

- Generation X (born 1965-1980)

- Millennials (born 1981-1996)

- Generation Z (born 1997-2012)

Did it surprise you that Gen X women are more likely to save than invest a windfall while Boomers and Millennials are more likely to invest? Travel seems to be a priority among the generations.

Ellevest also found that just 38% of women have a financial team that can help them “navigate” a financial windfall. At ProVise, we believe in financial planning for your life and lifestyle and can help you navigate a financial windfall.

________________________________________________________

i Cerulli Anticipates $84 Trillion in Wealth Transfers through 2045. https://www.cerulli.com/press-releases/cerulli-anticipates-84-trillion-in-wealth-transfers-through-2045

ii Survey: The Great Wealth Transfer Will Make Women More Affluent and More Confident Than Ever. https://www.ellevest.com/magazine/personal-finance/great-wealth-transfer-survey#:~:text=Of%20the%20women%20we%20surveyed,life%2Dchanging%20amount%20of%20money.

WORKING IN THE CLIENT’S BEST INTEREST

Ever since ProVise became an SEC Registered Investment Adviser in the late ‘80s, we have acted under a fiduciary standard of care placing our clients’ interests ahead of our own. Although most investors think their adviser is working in their best interest, they are not required to do so. Over the past decade, the regulators have pushed the issue to require them to do so, and each time the industry has pushed back suggesting among other things that the regulation is overly burdensome and will limit advice to the smaller investors.

The CFP Board of Standards recently conducted a poll of the American consumer that “reveals that nearly 97% of Americans agree that the financial professional who provides one-time recommendations or other one-time advice about retirement investments should be required to act in their client’s best interest This includes a recommendation to roll over funds from a workplace retirement savings program (such as, for example, a 401(k) plan) into an IRA or an annuity.” Just imagine in this time of great disagreement that 97% could agree on anything. We hope that those who oppose doing the “right” thing every time in the client’s best interest is not just “right”, but good old-fashioned common sense. In the end, if it is best for the client, it will be best for everyone.

NEEDING A CPA? MAY BE HARD TO FIND

As is true with several professions, the number of people becoming accountants/CPAs is dwindling and the number who are retiring is increasing. Some firms have turned to sending easier tax returns to overseas accountants, while others are significantly raising their fees or having a minimum fee. Some are simply telling their clients to find someone else to prepare the return.

This is an industry-wide problem, and a problem for many clients. What are the alternatives? First, there are many free services for senior citizens with relatively uncomplicated finances. There is always the opportunity to do it yourself, but you will likely want to buy some software. Next, you might consider one of the national firms, or at the other end of the spectrum, an individual who freelances. This is a difficult situation that is likely only to get worse.

IF TAXES ARE TOP OF MIND, DON’T LIVE HERE

The website WalletHub has once again brought reality to light by determining which states have the highest tax rates based on income. The high-income category is defined as those with an income of $150,000 or more. Here are the top ten states with the highest rates shown on a percentage basis:

10) Minnesota – 10.57%

9) Kansas – 10.81

8) California – 10.87%

7) Illinois – 10.93%

6) Maryland – 11.53%

5) Washington, DC – 11.82%

4) New Jersey – 11.97%

3) Connecticut – 12.01%

2) Hawaii – 12.08%

1) New York – 13.06%

Okay, let’s admit it – there are a few surprises here. Kansas at #9…really? California at only #8. Where is Massachusetts, which is often referred to as “Taxachusetts”? No wonder that so many folks are migrating from these 10 states.

MORE 401(K) MILLIONAIRES THAN EVER

According to Fidelity, there are now more 401(k) millionaires than ever as of the end of last year. Although the number went down at the end of the 3rd quarter, the market jumped in the last three months of 2023, and the number of millionaires was 11.5% higher than at the end of the 2nd quarter. The average contribution was 13.9% of employees’ salary when combining both their savings rate and the match from the employer. Seventy-eight percent of all savers were saving enough to get 100% of the employer match. The average account had a value of $118,600.

DINK — THE NEXT BIG THINGS FOR YOUNG PEOPLE

There is a growing demographic among young people calling themselves “DINKs,” an acronym standing for “Dual Income, No Kids.” This label has gained popularity among individuals and couples who have made the conscious decision not to have children, or who prioritize their careers, personal interests, and leisure activities over parenthood. Millennials (born 1981-1996) and Gen Zers (born 1997-2012) find themselves increasingly deliberating the merits of starting a family, particularly when considering the impact on their free time and financial stability.

The absence of financial responsibilities associated with raising children often results in DINK couples enjoying higher disposable incomes. This financial freedom empowers them to partake in luxury experiences, travel extensively, pursue hobbies, and secure a comfortable future for themselves. Notably, many DINKs aspire to early retirement, with a significant number achieving this milestone in their 50s or even 40s.

While the DINK lifestyle offers numerous advantages, it is not without its challenges and criticisms. DINK couples may encounter skepticism or misunderstanding from those who cannot fathom why they would forgo the joys of parenthood. Additionally, they may face questions about their legacy or societal contributions in the absence of children.

In conclusion, the DINK movement represents a significant shift in societal attitudes toward parenthood and family life. By choosing to remain childless, DINK couples are asserting their autonomy, prioritizing their personal and professional aspirations, and challenging traditional expectations. While this lifestyle may not be for everyone, don’t be surprised if you hear of more people following this trend going forward.

The Couples Embracing the DINK Label – WSJ

We hope you continue to stay safe and well.

Proudly and successfully serving our clients for over 38 years. As always, we encourage you to call or email us if you would like to discuss anything.

Recent Comments