WOW! WHAT A DIFFERENCE A YEAR MAKES

This time last year almost everyone was sure that the interest rate increases would lead to a recession. While we didn’t rule out the possibility of a minor recession, we believed the recession had a greater chance of occurring in 2024. Now, the experts are discounting the possibility of a recession in 2024. We think the possibility of a recession is not as eminent in 2024, but a brief and mild recession cannot be ruled out.

That is the economy. What about the stock market? In 2023, the magnificent seven (Apple, Alphabet, Amazon, Meta Platforms (Facebook), Microsoft, NVIDIA, and Tesla) made up the overwhelming majority of the stock market gains. The other 493 companies in the S&P 500 contributed in a variety of ways, but nothing close to the seven.

The equity markets made a huge run the last two months of the year after overselling took place in late summer and early fall and then the “surprise” announcement from the Fed indicating that they expect to cut short-term interest rates three times later next year. It wasn’t a surprise for those who watch the Fed the way we do because they said back in June of 2023 that they thought they would cut rates four times in 2024. Wall Street often has a short memory.

Many will say that the December rally particularly stole some growth from 2024 and that is probably true, but that doesn’t mean we can’t have a good (not great) year. While the magnificent seven are overstretched by many valuation metrics, some of them should still increase this year. We are betting that the other 493 companies may take their turn to shine in the sun. This trend started in November, and we expect it will continue.

Additionally, money markets had more money than ever during December and if any of this money finds its way to the stock market it should be a positive. Expect a positive year that might trickle into double-digits. Fear from last year seems to be moving toward greed in 2024, so expect the markets to continue the volatility of the past few years.

MAGNIFICENT SEVEN VS. THE WORLD

There is no denying that the Magnificent Seven had a tremendous run in 2023. By some measures, they accounted for about 65% of the gain in the S&P 500. In fact, they are somewhat reminiscent of the run-up in the late 90s with the dotcom craze.

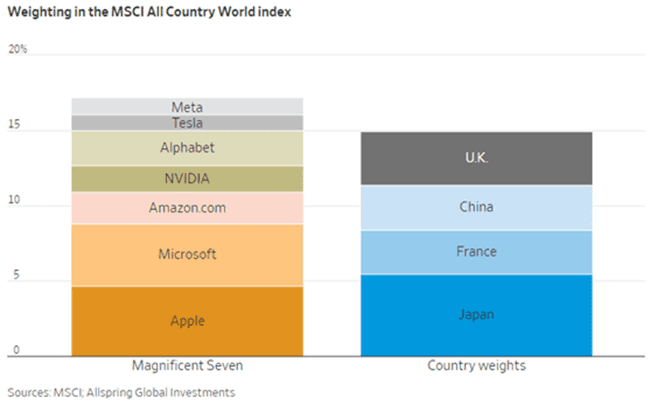

One big difference – these companies have positive cash flow and earnings. Still, it is hard to believe that there will not be some reversion to the mean in 2024. Just how big are these companies on a world basis? In the chart below they are bigger than the total for the United Kingdom, China, France, and Japan. Mind boggling, isn’t it?

TRADE TARIFFS – THE GOOD, THE BAD, THE UGLY

As the presidential race intensifies, the discussions surrounding international tariffs take center stage. Some candidates desire to increase tariffs on imported goods, especially those from China. Although tariffs serve as one of the most impactful tools in international relations, they carry a wide range of consequences for the involved nations and the global economy.

Proponents of tariffs argue that higher barriers to entry can shield domestic industries against foreign competition. In theory, this could keep companies from leaving the U.S. and create local jobs. Additionally, imposing elevated tariffs on goods from specific nations, such as China, might compel companies to establish ties with alternative countries. This, in turn, could diminish the U.S.’s dependence on Chinese products and raw materials. Some argue that increasing tariffs could help reduce the U.S. trade deficit. This assumes that domestic manufacturing would take the place of international suppliers.

On the other hand, tariffs often translate to elevated prices for goods, occasionally leading to inflationary spikes. Given the Federal Reserve’s ongoing progress in curbing inflation, such a move could potentially limit these efforts. Although it is wise for companies to have several suppliers, it can take years to establish new partnerships and create the supply chains necessary to keep up with production advocating for a more measured approach.

While the primary goal of tariffs is to shield domestic industries and fix trade imbalances, their implementation also introduces the risk of economic disruptions, consumer price increases, and strains on international relations. Finding a balance between these factors becomes ever more important in our complex global economy.

401(K) PARTICIPANTS ARE AT RECORD LEVELS

It wasn’t just the increase in equity markets that lifted many employees to begin participation in a 401(k). Over the past decade, plan advisors (like ProVise) have been encouraging the use of automatic enrollment and an automatic 1% annual increase of salary deferment, both of which helped push participation north. The average participant’s balance was $112,572 with the median being $27,376. The disparity between the average and median is a direct result of many small accounts as 33% of the accounts have a value less than $10,000. At the other end of the range, only 12% had balances greater than $250,000.

SOAK THE RICH IS THEIR CRY

What do these seven states have in common; Connecticut, New York, Maryland, Washington, California, and Hawaii? They either have introduced legislation or are expected to enact a wealth tax in various forms. Imagine a 30% capital gains tax for residents of New York City on top of the 20% rate for the Feds. Fifty percent (50%) tax on gains is not going to raise more money. Instead, it will cause people to move. How about California imposing a 1.5% tax on all wealth over $1 billion? Same effect – people will move out of California even faster than they already do. At the end of it all, it may be the legislators who cry the most when they are booted out of office.

CONGRESS HAS A LOT TO DO

Congress left for the holidays with a significant amount of debate and legislation left on the table. In short, they punted into the new year. We have a looming date in January for the first of two potential government shutdowns. Our bet is that they will punt once again.

Decisions need to be made about providing aid and weapons to both Ukraine and Israel. Both will probably get something, but not as much as being requested by the President. Then Congress needs to consider additional funding for the Defense Department because significant amounts of stockpiles have been used up. If the U.S. really got involved in a military conflict, we might lack the necessary weapons and supplies.

Oh yeah, and let’s not forget taxes. Democrats and Republicans will be debating how to handle the business tax breaks that are expiring. Democrats will be looking for more money being spent on social issues. While it is possible that they will pass a narrow tax bill this year on minor issues, we do not expect much agreement on taxes between now and the November election. The next Congress will need to address the expiring provisions of the 2017 tax act at the end of 2025 as those provisions will revert back to the way they were prior to the 2017 changes.

WELCOME TO THE FUTURE…ONCE AGAIN

Every year as the calendar turns from December to January, there seems to be a sense of excitement and positivity in the air. It is no different this year. It is a fresh start for the economy, markets, resolutions, renewed and new friendships, new opportunities both personally and professionally.

With this new year let’s hope for peace around the world, tolerance of those with different beliefs, and a willingness to make each day better than the day before. It is also a time to give thanks. So, from all of us at ProVise we want to thank you for believing in us and our ability to assist with your financial planning and investment management needs.

HAPPY NEW YEAR!!!!!!!

We hope you continue to stay safe and well.

Proudly and successfully serving our clients for over 38 years. As always, we encourage you to call or email us if you would like to discuss anything.

Recent Comments