Highway Robbery from Family Members

Unfortunately, when elderly individuals are the victims of financial abuse, 88% of the time it can be traced to either a family member, close friend, or caregiver. An AARP report estimates this abuse at a staggering cost of $28.3 billion annually. Because the abuser is someone close to the victim, the victim often fails to report the crime because they don’t want to “hurt” the abuser and also because the victim is too embarrassed. As a result, only 12.5% of cases were reported in 2020, according to the Journal of Applied Gerontology. Further, the average losses from a known abuser were $50,000 and $17,000 from strangers.

As Bad as it is, Retirement Saving isn’t All That Bad

ProVise provides 401(k) services to many companies acting as a fiduciary in providing investment advice to the plan sponsors. We try very hard to drive the costs down, select excellent investment choices, and drive participation up. One of the ways we do the latter is by providing individualized advice. According to Vanguard’s “How America Saves” report, this individualized advice is what every plan provider like ProVise should be doing, but unfortunately many do not, we will get back to that in a moment. What can we learn from the report that encompasses over 5 million retirement savers?

One of the things we strongly recommend when setting up or modifying a plan is automatically enrolling participants. As a result of automatic enrollment, we typically see 8 out of 10 employees participating when a plan is available.

While individualized advice is generally available for larger plans, only 41% of the participants in smaller plans receive this benefit. The average participant contribution is 7.3% of salary which is an all-time high. In large measure, this is a result of another feature we stress for each plan – automatic annual increases in contributions.

We also believe that all plans should offer a Roth contribution – one that is not tax-deductible but grows tax-free. This feature is especially important for those that do not qualify for a Roth IRA due to income limitations. Again, most large plans offer this, but not many smaller plans. We encourage everyone to invest as much as possible, but at least contribute enough to get 100% of the match that may be offered by the employer.

If you are an employer with a 401(k) that does not have all of these features or has not done a fiduciary review of the plan’s costs and investment choices within the past three years (we do this automatically for all of our plans at no additional cost), please give us a call at 727-441-9022 to learn more. Oh, by the way, it comes with a money-back guarantee – if the savings we identify don’t pay for the review within two years, we give back the cost of the review.

Tax Simplification?

When Congress wants to change tax law, they often hide behind the words “tax simplification” to appeal to taxpayers and ultimately voters. This term is oxymoronic because these changes rarely simplify anything. However, the Tax Deadline Simplification Act proposes “tax common sense.” See, Congress can’t get away from the word. Currently, taxpayers who must file estimated quarterly taxes do so on April 15, June 15, September 15, and January 15. The new bill would change the dates to 15 days after each quarter – April, July, October, and January 15th. This makes a lot of sense to us and hopefully, it receives bipartisan support.

Investment Fraud is on the Rise

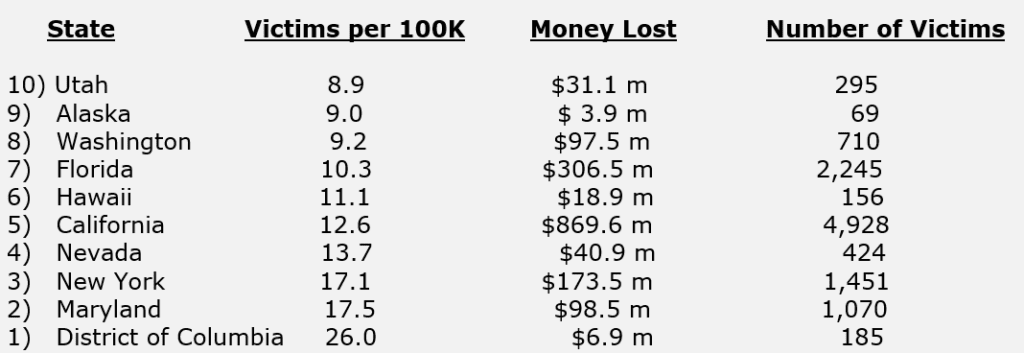

Wily fraudsters pick on individuals who are often unwary and sometimes very sophisticated investors. According to the Federal Trade Commission, investors were defrauded out of $3.82 billion in 2022 which is up significantly from 2021 with a mere $1.7 billion stolen. Why did the fraud double? While Ponzi scams, telephone calls, and emails accounted for a lot, it was crypto schemes accounting for a whopping $2.57 billion in 2022 that led the pack. Remember the saying “if it is too good to be true, then it probably is.” Greed is a terrible thing and Carson Law identified the top ten states in their 2023 State of Investment Fraud report:

America’s Richest Self-Made Women

Forbes’ published its ninth annual list of America’s fifty Richest Self-Made Women. To join this exclusive club of entrepreneurs, executives, and entertainers, the women needed a minimum net worth of $225 million.

Do you recognize any of these women who made the list including Clearwater native and founder of Spanx, Sara Blakely; and Sheila Johnson, owner of the Innisbrook Resort in Palm Harbor and home of the annual Valspar PGA tournament?

Just for fun, we have chosen several women who made this list. Can you list the highest net worth women from the sample below from highest to lowest? To give you some help, we will note the women’s sources of their wealth:

- Sara Blakely – Founder of Spanx

- Oprah Winfrey – TV shows

- Sheryl Sandberg – Facebook

- Sheila Johnson – Cable TV and hotels

- Diane Hendricks – Building supplies

See the results at the bottom of the ProVise Perspective$.

Commercial Space Tourism Gaining Traction Again?

In recent years, private citizens have ventured into space as “private astronauts,” spending a hefty price tag of $450,000 or more. What an expensive trip for the average family. While this venture is for the ultra-affluent, could this be a streamlined affordable endeavor for everyone in the distant future? More companies are doing flights and even some start-ups are raising funding for what they are calling “space hotels.” Although full realization will take time, the industry fosters exploration and is pushing companies to advance.

Nevertheless, the recent tourist Titanic submersible disaster underlines the dangers that come with private-backed complex explorations. Catastrophic failures pose meaningful risks, and the investment case is lacking as the high price tag of these missions makes turning a profit extremely difficult. Aerospace and defense companies with profitable core businesses that can fund space tourism side projects are the likely winners in this space (no pun intended). If history and American ingenuity have taught us anything, it’s that where there’s a blank check there’s a way.

How Much Money Does It Take to be Wealthy?

Ask Charles Schwab…

The Charles Schwab 2023 Modern Wealth Survey reports the magic number is $2.2 million. Notwithstanding this sum, 48% of Americans said they “felt” wealthy even though their average net worth was $560,000. It is probably fair to say that many of them were measuring wealth by nonmonetary terms like health, family, friends, work satisfaction, and environment.

Those who are accumulating wealth such as the Millennials with 57% and Gen Z with 46% identify themselves as the “wealthiest.” At the other end of the spectrum, only 40% of the Baby Boomers felt wealthy. Not too surprising here as money in this group is a little more important for those that are retired or about to be. According to MoneyWise, the average Baby Boomer only has $202,000 saved for retirement. Using the 4% rule, it provides only $8,000 a year of income. Add Social Security of about $48,000 for a married couple and they are living on $56,000 a year. Sandwiched in between is Gen X at 41%.

Horse Racing and The Triple Crown

Fifty years ago, a horse named Secretariat won Belmont Stakes by a record-setting 31- length victory and grabbed the Triple Crown. This season three different horses each claimed a race: Arcangelo at the Belmont Stakes, Mage at the 149th Kentucky Derby, and National Treasure won the Preakness.

Now, here are two little-known facts about that great horse, Secretariat. In 2023, eight of the 20 horses in the Kentucky Derby trace their lineage back to Secretariat and National Treasure is an offspring as well. As crazy as this is going to sound, 24 out of 29 horses that won a Triple Crown race over the past 10 years have Secretariat’s DNA. Very few things in life are guaranteed, but it seems likely that future champions will have Secretariat’s DNA. (Source: Thoroughbredracing.com)

Answers to Richest Self-Made Women

- #1 Diane Hendricks with $15 billion

- #13 Oprah Winfrey with $2.5 billion

- #17 Sheryl Sandberg with $1.7 billion

- #22 Sara Blakely with $1.1 billion

- #28 Sheila Johnson with $870 million

We Hope You Continue to Stay Safe and Well

Proudly and successfully serving our clients for over 37 years. As always, we encourage you to call or email us if you would like to discuss anything.

Recent Comments