SAVVY WOMEN INVEST ON PURPOSE – OCTOBER 24th & NOVEMBER 14th

at the Belleair Country Club

Join Susan Washburn and our ProVise team as we help empower women to take charge of their financial lives.

See the invite below for all the details and remember to RSVP to Susan Washburn at washburn@provise.com or call 772-532-1625.

COULD THIS HAPPEN AGAIN?

As we have previously discussed, the month of September is the worst month historically for markets. This past September did not offer any surprises as the S&P 500 declined by 4.8% with dividends reinvested. What does this portend for the rest of the year? Let’s look at the recent past. The last four Septembers for the S&P 500 produced the following returns: -3.8% in 2020; -4.7% in 2021; -9.2% in 2022; and -4.8% in 2023. The last three Q4s produced the following results: 2020 +12.2%; 2021 +11.0%; 2022 +7.6%; and 2023? Hopefully 4th quarter 2023 will follow the trend of the last few years. Let’s check back in January 2024.

3Q 2023 CORPORATE EARNINGS PREVIEW

Equity investors have endured some pain over the last two months, with the S&P 500 down nearly 7% in the combined months of August and September. Interest rates have undoubtedly been the culprit as stubborn inflation has kept the Fed’s foot on the gas pedal. Bulls have few catalysts to point to outside of a Fed pivot in interest rates, the main lever being a recovery in corporate earnings. Wall Street analysts are expecting to see a bottoming out in earnings for the third quarter and positive growth in the fourth quarter for the first time in over a year.

The largest positive contributors are expected to come from the communication services and consumer discretionary sectors while the largest detractors are in the energy and materials sectors. For the year, analysts are forecasting slightly higher year-over-year earnings. That growth is then expected to accelerate dramatically over the next two years as companies lapse tough year-over-year comparison and profit margins expand. The ability of corporations to continue expanding margins will depend on pricing power and/or cost control. With inflation slowing and interest remaining high, we believe cost cutting will have to be the primary driver.

2023 YEAR END TAX PLANNING

We still have 75 days to do tax planning this year. Here are a few things to help with year-end tax and financial planning.

- What goals need to be modified based on what happened this year?

- What objectives were reached or fell behind?

- What investments created a gain or loss?

- Could you benefit from tax loss harvesting and offset gains against losses?

- Remember to rebalance your portfolio to keep your portfolio’s asset allocation in balance.

- Could you postpone income into 2024? If so, is it better to take the income this year or push it to next year?

- Max out retirement plan contributions to your 401(k)

- If you are over 70.5, you may use your IRA to make a qualified charitable distribution and avoid paying taxes on the donation.

- Could you gift appreciated assets to avoid paying a capital gains tax?

Talk with your accountant about running a preliminary tax return for 2023 to help you answer these questions.

It’s much better to plan now and not wait until it is too late!

OIL PRICES AND THE MIDDLE EAST

Oil prices have had a volatile year so far and it looks like we’re in for more of the same with the recent conflict in Israel and Gaza. This year, the price of crude oil has bounced between $67 and $93, but many expect the price to increase with added tensions in the Middle East.

While neither Israel nor Gaza are significant oil producers themselves, their geographical proximity to major oil-producing nations like Saudi Arabia, Iraq, Iran, and the United Arab Emirates has raised concerns about future oil supply. Recent reports from The Wall Street Journal have suggested Iran’s involvement in the attack on Israel, further complicating the situation. Iran ranks among the top 10 oil-producing countries globally, and any disruptions to its oil production could exert substantial pressure on the world oil market.

Historically, geopolitical tensions in the Middle East have been a pivotal factor influencing oil price fluctuations, and the Israel-Palestine conflict is no exception to this trend. The risk of supply disruptions, market sentiment, and the influence on key players all contribute to the uncertainty surrounding oil prices when such conflicts arise. In our interconnected world, the stability of the Middle East is of major importance to global energy markets and individual consumers.

EMAIL AND WIRE FRAUD

Fraudsters scheme about how to steal money. It is not unusual for us to get a client email requesting us to wire money to buy a car or home or pay for a vacation. But as many financial institutions have found, sometimes that email doesn’t come from the real client who might have been hacked and not even know it.

You might even get an email that looks like it came from the bank, credit card company, or other financial institution requesting you to transfer funds. What does ProVise do to protect against this kind of fraud? If we get an email requesting the movement of funds, our first move is to review the request and look for anything out of the ordinary. Next, ProVise will call you on one of the phone numbers we have in our records. Often, the fraudster will say that the phone was lost, or that you are not at home, so call this other number. We NEVER call that number we ALWAYS call your number. Once verified, we will proceed with the transfer.

Additionally, you can prevent Email Compromise by remembering these red flags:

- Urgency of Request: A request to transfer funds is sent with a pronounced sense of urgency.

- Different Domains: Email communication originates from an unknown or spoofed domain.

- Out of Contact: The requestor is unreachable but insists on the urgency of the transfer.

- Language and Grammar: Syntax is different or erroneous.

- Multiple Emails: Multiple recipients receive emails requesting the transfer of funds.

- Incorrect Context: Emails are not in the standard context normally encountered or for alternate business purposes while requesting a transfer of funds.

- Secrecy: The email sender requests that transfer information be kept secret.

INHERITED IRA BENEFICIARY TRAPS

Back in the good old days, one of the most powerful wealth planning tools was the Stretch IRA. When an IRA owner dies and leaves the IRA proceeds to a non-spouse beneficiary, the money could be withdrawn over the life expectancy of the beneficiary. Imagine an infant being the beneficiary of an IRA from a grandparent and being able to “stretch” required minimum distributions over a lifetime of maybe 80 or 90 years. Talk about power.

But just before the pandemic, Congress passed and President Trump signed the SECURE Act, taking away this popular strategy for most non-spouse beneficiaries if the decedent passed after December 31, 2019. Under current law, the IRA must be completely emptied by the end of the 10th year following the death of the IRA owner. Four beneficiaries are exceptions: 1) the spouse; 2) a disabled or chronically ill beneficiary; 3) a child (not grandchild) who has not reached the age of majority (age 21); and 4) a person not more than 10 years younger than the IRA owner. These four can continue to stretch the IRA. A spouse also can roll over the IRA to an IRA in their name.

Initially, we thought that the beneficiary could take it all upfront, or wait until 10 years before taking anything, and everything in between. This flexibility gave each beneficiary the ability to customize a withdrawal plan. However, about 18 months ago, the IRS issued a ruling saying that if the IRA owner died after the required minimum distribution date, then the beneficiary must take a required minimum distribution based on the beneficiary’s life expectancy no later than December 31st in the year following the death of the IRA owner. If any balance still existed in the 10th year, then 100% needed to be withdrawn in that last year. The beneficiary could always take more than the required minimum amount in any year if desired. This new rule does not apply if the IRA owner died before the required minimum distribution date.

Because this ruling came after the fact, it would have meant that taxes and penalties could have been imposed on those beneficiaries who didn’t take distributions in 2021 and 2022. Thus, the IRS said it would exempt those years from the distribution requirement and penalties. Wow! That was nice of them. Because of technical complications, the IRS has now exempted distributions in 2023. Beginning 2024, those beneficiaries must begin distributions and still must empty the account by the 10th year following the death of the IRA owner.

Are the rules different for an inherited Roth IRA? The simple answer is “yes”. While the ten-year rule still applies, there are no required distributions. Since these grow tax deferred and the proceeds are never taxed, it typically makes sense to leave the money in the Roth IRA for as long as possible.

In either case, if you have inherited an IRA since January 1, 2020, you need to visit with us and your tax professional. Don’t delay as it could be hazardous to your wealth.

CHARITABLE GIVING UP BIG TIME!

During COVID, Americans stepped up and donated a record amount to charity in 2020. In 2021, donations declined. But according to the 2023 Bank of America Study of Philanthropy, donations were up 22% in 2022 among affluent donors and are back at pre-pandemic levels. That is good news, but overall, the number of households giving is still below pre-pandemic levels. Most of the money went to religious organizations (39%) and higher education (24%).

STUDENT LOAN DEBT REPAYMENT AND FORGIVENESS

Back in 2020, as part of the government’s aggressive efforts to combat the pandemic-stricken economy, the Department of Education paused payments on federal student loans, providing relief to tens of millions of individuals. After a Supreme Court case thwarted President Biden’s efforts to completely forgive those loans, individuals must now resume repayments as of October 1st. Investors have understandably asked, “How will this affect the economy and the market?”

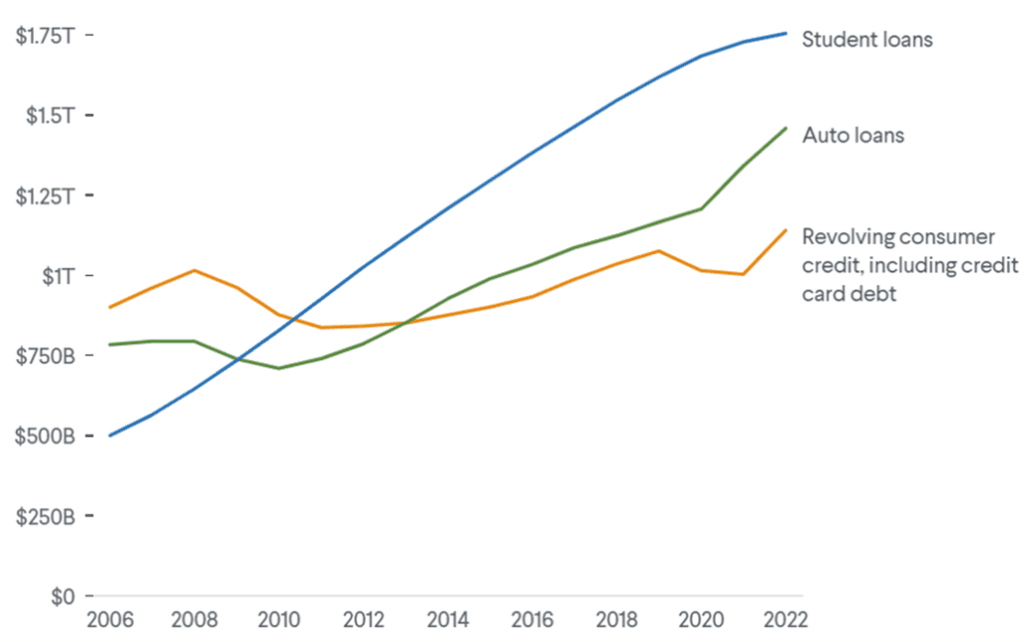

The size alone of the student loan market warrants our attention. Approximately $1.7 trillion in student debt represents nearly 10% of consumer spending and exceeds credit card and auto loan indebtedness. The debt growth is staggering: Borrowers’ balances ballooned by 25% from 2009-2021. Of the 43-46 million holders, more than half (27.4 million) are in forbearance.

The Covid-era forbearance program provided welcome relief to many pocketbooks and helped fund additional spending and borrowing. As households resume making $70 billion in annual (previously paused) loan payments, we could see some of those impacts reverse.

For instance, consumer spending could feel the pinch. Every 1% increase in debt translates to a 3.7% decline in consumption. It’s easy to see why. Monthly payments averaging $393, or $217 billion annually, equate to 1.1% of disposable income. That means fewer dollars allocated to savings, which at 4.3%, is the lowest rate since 2008. Millennials, who hold a disproportionate amount of the debt, may see their spending hampered by 65-85 basis points (one-hundredth of one percentage point).

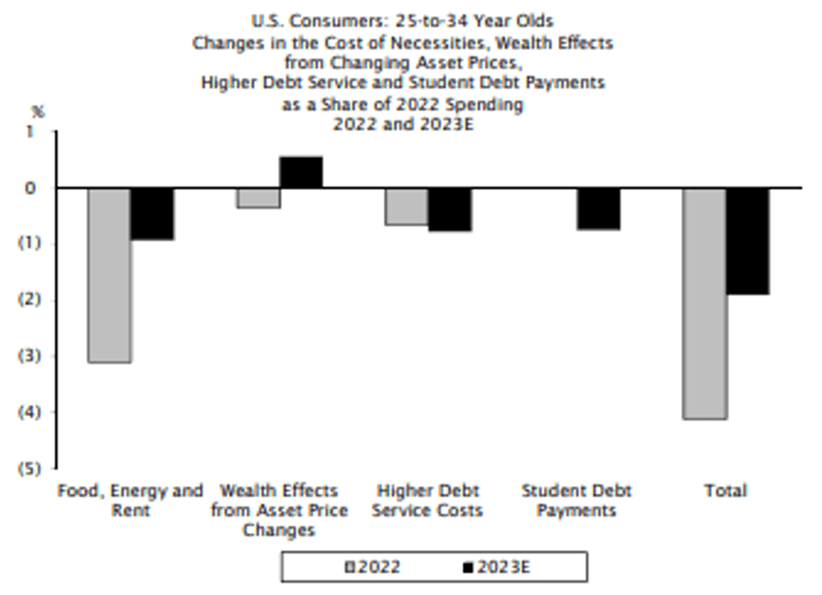

U.S. Consumers: 25 to 34 Year Olds Changes in the Cost of Necessities

Source: Federal Reserve Board, U.S. Department of Commerce, Investment Company Institute, The Vanguard Group, Census Bureau, and Empirical Partners Analysis. Data as of September 30, 2023.

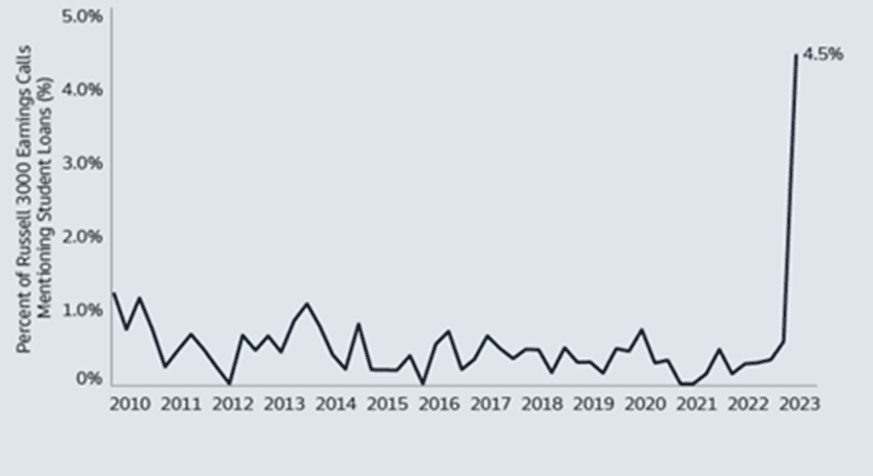

The already-struggling housing market, for instance, may suffer because 36% of student debtholders are less likely to purchase a house. Even analysts are concerned, with company earnings calls seeing a growing number of references to student loan repayments in Q2.

Source: Goldman Sachs GIR and Goldman Asset Management. Data as of September 10, 2023.

Despite these potential drags, we see a plausible case for limited negative impact. High-earning households comprise the bulk of outstanding debt (40% of households are in the top quintile) and are better positioned to make payments. They also tend to hold the bulk of the $600 billion in excess savings, which can help offset the expense and tend to have higher earning power.

In addition, student loan debt as a percentage of GDP has declined for the past two years, from 8.3% in 2020 to 6.7% in 2022, a signal that greater output can combat the debt drag. Believe it or not, the inflation rate of college tuition has been declining for a couple of decades.

Finally, although the United States Supreme Court ruled against wiping out student loan debt, the Biden Administration is proposing two workarounds to help lessen the strain on household budgets: Income-driven repayments (IDRs) and SAVE plans promise some relief.

U.S. Student Loan Debt Has Grown Tremendously

Source: Council on Foreign Relations with data from Federal Reserve Bank of St. Louis. Data as of August 22, 2023.

While repayments may provide a minor headwind to overall economic growth and consumer spending, the student loan picture is just one piece of a very complicated puzzle. Consumer pocketbooks will certainly continue to get pinched by repayments as well as soaring interest rates on credit cards and auto loans. But it’s also helpful to remember that these payments are simply a resumption of what borrowers were paying before the pandemic.

We’ll continue to keep a close eye on both retail sales and delinquency rates on all types of consumer debt.

We hope you continue to stay safe and well.

Proudly and successfully serving our clients for over 37 years. As always, we encourage you to call or email us if you would like to discuss anything.

Recent Comments