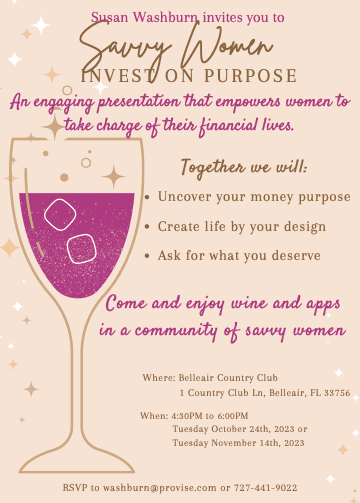

SAVVY WOMEN INVEST ON PURPOSE – NEXT ONE ON NOVEMBER 14th

at the Belleair Country Club

Join Susan Washburn and our ProVise team as we help empower women to take charge of their financial lives. We had a great turnout for out October event and hope that you will bring a friend and join us.

See the invite below for all the details and remember to RSVP to Susan Washburn at washburn@provise.com or call 772-532-1625.

SOCIAL SECURITY INCREASE SET FOR 2024

After an almost record-breaking increase for 2023 of 8.7%, the cost-of-living increase for Social Security in 2024 will be only 3.2%. This is less than the 3.7% year-over-year inflation rate announced in September, but above the average rate of the last 20 years of 2.6%. How can the 2024 increase be so much lower? As we have reported in the past, the Social Security Administration uses a different measure of inflation – it uses the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The increase also affects the earnings that are subject to Social Security taxes and will increase from $160,200 to $168,600. For those over the upper limit, they will pay $10,453 in Social Security taxes next year.

HEALTHCARE COSTS IN RETIRMENT

We are in the annual open enrollment season when millions of seniors are making decisions about Medicare Parts A, B, C, and D along with supplements to cover what Medicare does not. For those in the top tax bracket, it isn’t hard to get basic premium costs to rise above $20,000 and that is BEFORE paying any bills not covered by insurance.

According to a Nationwide Retirement survey, 66% are “terrified” (the report’s words, not ours) about health care costs in retirement and are fearful of a major illness wiping them out and destroying those golden years. These fears are not unfounded as the Center for Disease Control estimates that 60% of older Americans face at least one form of chronic disease. 72% said they wished they understood Medicare better and the total costs of health care in retirement. In the survey, the respondents estimated that total costs would be about $55,000 while Fidelity’s most recent analysis estimates it is closer to $315,000.

Choosing the “right” plan for retirement is difficult. During ProVise’s financial planning process, we routinely increase clients’ expectations for healthcare costs to make sure they know how high these expenses can be. But according to the Nationwide survey, 70% do not have a financial plan. In short, they are winging it.

We have access to a valuable software program that for a modest cost ($400) helps unravel most of the mystery of buying health insurance in retirement potentially saving you thousands each year. While we assist you in the process of analyzing your healthcare options, we do NOT sell health insurance. After reviewing the report, we will be pleased to refer you to a trusted health insurance agent. So, give us a call at 727-441-9022 or email us at info@provise.com if you would like to learn more.

AUTOS ARE MORE EXPENSIVE AND MISSED PAYMENTS ARE UP

It is no secret that almost everything is more expensive than it was a few years ago. However, the cost of acquiring a new auto has gone through the roof over the last three years. Barron’s reports that the average cost used to be $39,000 and today the average cost is $48,000. This annual increase of 7.2% soars above the average rate of inflation during the same time.

However, financing your car purchase also contributes to the total cost with interest rates going from 4.6% to 7.4% today. Thus, on a six-year loan for 85% of the new car price the payments have gone from $514 to $703, or a 36% increase. According to a recent Bloomberg article, the delinquency rate for subprime borrowers at least 60 days past due is 6.11%, the highest level since 1994. Given that many are now facing paying back their student loans, it is likely that the percentage will go even higher.

BITCOIN GETS BOOST FROM LEGAL VICTORY

Bitcoin is back in the headlines as Grayscale Investments looks to convert its Bitcoin trust to a spot cryptocurrency ETF. The first of its kind, this marks a potential turning point in the nascent industry’s struggle to be taken seriously. Currently, investors seeking to gain exposure to cryptocurrencies in an exchange-traded fund (ETF) have had to settle for investments in cryptocurrency-related companies or cryptocurrency futures contracts. In August, the courts ruled that the SEC should not have rejected Grayscale’s application to convert its trust to a spot Bitcoin ETF and gave the regulatory agency until October 13th to appeal the court ruling. As the date approached and passed with no appeal from the SEC, Grayscale filed to register its $18 billion trust under the Securities Act of 1933. Should it become registered, the path to becoming the nation’s first spot Bitcoin ETF is just a matter of time.

Bitcoin has reacted positively, up 27% since October 13th and back to levels last seen in May 2022. The prospects of a spot Bitcoin ETF are certainly encouraging for crypto enthusiasts as it becomes more mainstream and easily accessible for investors. But before you fill your retirement account with Dogecoin, we want to remind you of the investment merits (or lack thereof) which do not change with this court ruling. Cryptocurrencies lack two of the three fundamental drivers of investment return, namely earnings growth and income. Investors are relying solely on price multiple expansion for returns. In other words, the only fundamental driver of returns is someone else paying more for the same asset and sentiment can shift quickly when intrinsic value is so opaque or non-existent. We believe blockchain (the technology behind cryptocurrencies) will play an increasingly valuable role in many industries, but the verdict is still out on the investability of these digital coins.

We hope you continue to stay safe and well.

Proudly and successfully serving our clients for over 38 years. As always, we encourage you to call or email us if you would like to discuss anything.

Recent Comments