HOW WAS YOUR LABOR DAY VACATION?

While most of us enjoyed Labor Day weekend, aka as the unofficial end of summer, Congress finally found its way back to the Capitol after being gone for nearly a month. Now, they only have 15 days left to avoid a government shutdown. No worries, they need to approve 12 spending bills or less than one per day.

Look for a temporary bill to keep the government running maybe past the first of the year. Additionally, they must also reauthorize the air traffic control system so that planes can keep flying, along with a farm bill, and approve emergency funds for the Maui fires and Hurricane Idalia. Oh, did we mention food stamps? Now where did we put that box of Band-Aids?

THE IMPACT OF INTEREST RATES ON THE ECONOMY: HOW LONG AND HOW VARIABLE?

“Monetary actions affect economic conditions only after a lag that is both long and variable.”

– Milton Friedman, winner Nobel Prize for Economic Sciences

Today, we hear central bankers discuss “long and variable lags” in monetary policy that it almost appears cliché. But it wasn’t always understood that way. Back in the 1960s, Milton Friedman was one of the first economists to argue that interest rate increases and decreases, and other policies pursued by the Federal Reserve, can take time to impact the economy and can do so at an unpredictable rate. The economy’s experience over the last couple of years, however, has demonstrated how difficult it is to accurately predict the impact of monetary policy. Nearly a decade and a half of ultra-low interest rates have inoculated the economy against the Fed’s rate hikes, allowing the economy to chug along despite much higher rates.

After slashing interest rates to near zero in March 2020 in response to the pandemic, the Fed aggressively raised rates 11 times in a year and a half to combat inflation. In July, the hike bumped the federal funds rate to 5.5%, its highest level in over two decades. Those short-term interest rate increases also have contributed to the rise in long-term rates. The yield on the 10-year Treasury bond reached its highest level since 2007 and mortgage rates are at their highest since 2000.

Typically, higher interest rates would begin to slow the economy – admittedly with a potentially “long and variable lag” – by making it harder to borrow money. Companies would either borrow less or would simply have to spend more of their earnings paying the interest on that debt. Similarly, with mortgage rates higher, consumers would be able to afford less house and would have to use more of their hard-earned dollars to pay off credit card debt.

Given these extraordinarily steep increases in rates, why hasn’t the economy slowed more? During the last decade-plus, many companies took advantage of ultra-low interest rates to extend the maturity of their debt obligations. With that trend, the average maturity of the overall bond market has grown substantially longer. The average duration of the Bloomberg Aggregate bond index, for instance, was around 4.5 years in the early 2000s. Then as interest rates continued to fall, duration increased, peaking at about seven years.

Now with higher rates, we’ve seen the opposite happen – company managements are choosing to either not take as much debt or to take out shorter-term debt. Luckily, many companies don’t even have to make that choice just yet because their loans in many cases don’t come due for several years. Still, higher interest costs are beginning to bite. Corporate bankruptcies are climbing and default rates on both investment grade and high yield loans are increasing. While those increases in defaults are thus far modest, S&P projects that they’ll climb from 3.2% to 6.3% over the next two years, a rate worth paying attention to.

When it comes to the consumer, we can see some of the same effects happening. Like companies, many homeowners took advantage of low interest rates to refinance their mortgages. Nearly two-thirds of all mortgages in the country carry an interest rate below 4%, compared to the current rate of about 7.5%. Here too, despite much higher mortgage rates, the majority of homeowners remain comfortable.

But that doesn’t mean that consumers are completely isolated from higher rates. Unlike mortgage loans which typically carry a fixed rate for 30 years, credit cards carry variable interest rates that change quickly based on market conditions. Credit card balances reached above $1 trillion just as the average interest rate on those loans skyrocketed. Delinquencies on credit card loans have been climbing and are now back to their pre-pandemic level. So, consumers who don’t own a home and carry credit cards are being particularly squeezed.

When the Fed began its interest rate hikes in 2022, the economy was uniquely insulated from those rate changes, which has certainly contributed to the enduring persistence of economic growth. While both corporate bankruptcies and credit card delinquencies are climbing, they remain relatively low by historical standards. The key will be how long interest rates remain at this higher level. For every year that rates remain high, more companies will need to take out a new loan, and more individuals will need to buy a new house or use their credit card. In that sense, the future path of the economy will be dependent on not just the Fed’s “long and variable lags” from interest rate hikes, but also how long the central bank takes to lower rates.

TWO YEAR DELAY IN SECURE 2.0 PROVISION

The provision in SECURE 2.0 that would require anyone who made over $145,000 and wanted to make catch up contributions to their retirement plan to put the contribution into the Roth portion has been delayed until 1/1/26. When the delayed change takes effect, many people might be upset that they will not be able to continue making deductible contributions that grow tax deferred. Instead, they will make after-tax contributions that grow tax free. This change will only be advantageous if one’s tax bracket in retirement is higher than it is today, which doesn’t usually happen. In short, it was a sneaky way for Congress to raise more taxes today.

AN UPDATE ON THE U.S. HOUSING MARKET

In March, we delved into the potential repercussions of rising mortgage rates on the thriving U.S. housing market. Since then, rates have continued their ascent, impacting the affordability of homes. Many analysts expected housing prices to come down significantly after several years of climbing upward. Although we’ve seen home prices drop on a year-over-year basis for five months this year, prices increased by 1.9% in July. So, what’s allowing the housing market to stay on top? Scarcity.

Active listings have dwindled by more than 7.5% since August of last year. This is due in large part to current homeowners’ unwillingness to move and trade their fixed, low mortgage rates for new rates around 7%. Coupled with continued high demand, this hesitancy to sell could effectively maintain elevated property prices well into the foreseeable future.

A couple of other factors to consider are the health of the economy and the labor market. Historically, a robust labor market, characterized by strong labor force participation, bodes well for the housing sector. Gainfully employed people are more likely to make their mortgage payments on time and in full. How will the housing market hold up if higher interest rates persist for longer than expected? Only time will tell.

The Fall in Home Prices May Already Be Over – WSJ

U.S. Home Prices Held Steady in June – WSJ

MORTGAGE RATES HIGHEST IN TWO DECADES

Just how high will interest rates go? Interest rates hit an average of 7.23% in late August, the highest since 2001. On top of rising home prices, homeowner’s insurance and flood insurance, people are astounded by the cost of a new mortgage. If you are thinking of buying a home, we don’t have good news for you. We expect mortgage rates to continue rising topping out in the 4th quarter of this year or maybe early in 2024. We believe that interest rates will stay higher for longer than most believe.

THE IMPACT OF HIGHER OIL PRICES ON YOUR PORTFOLIO

Consumers understand the negative impact of higher oil prices at the pump, but what does it mean for your investments? Oil prices have seen a resurgence, with the price of West Texas Intermediate (WTI) crude oil rising 30% over the last three months. Oil is an input cost for most companies in the S&P 500 and has a varying negative impact, barring energy companies. That said, companies may pass through some of these higher costs in the form of higher prices to customers. Additionally, higher oil prices partly reflect higher global economic growth expectations. These factors are usually enough to more than compensate for the higher input costs.

Consequently, stocks are positively correlated with the price of oil – meaning their prices move in the same direction – though oil prices tend to be much more volatile than stocks. Of course, there are times when the two move in opposite directions and this is most prevalent when there are major supply or demand disruptions in oil markets and during hyperinflationary periods. We experienced both scenarios recently in 2020 and 2022, respectively. Over the long term, higher oil prices tend to be accompanied by higher stock prices. So, the next time you feel pain at the pump, find some solace in looking at your retirement account.

FINALLY, MEDICARE TO NEGOTIATE DRUG PRICES

In the last week of August, the Biden Administration announced they will negotiate the prices of ten critical drugs, hoping to bring down prices and save Medicare money.

Medicare pays billions of dollars for these drugs each year. You can bet that President Biden will make this an important part of his reelection campaign and link it to the economy by declaring the move as part of Bidenomics. The ability for Medicare to negotiate was tucked into the Inflation Reduction Act but is being challenged in court by six drug manufacturers. Here is the list of the ten drugs, what they are used for, and the manufacturer:

- Eliquis, for preventing strokes and blood clots (Bristol Myers Squibb and Pfizer)

- Jardiance, for diabetes and heart failure (Boehringer Ingelheim and Eli Lilly)

- Xarelto, for preventing strokes and blood clots (Johnson & Johnson)

- Januvia, for diabetes (Merck)

- Farxiga, for diabetes, heart failure and chronic kidney disease (AstraZeneca)

- Entresto, for heart failure (Novartis)

- Enbrel, for arthritis and other autoimmune conditions (Amgen)

- Imbruvica, for blood cancers (AbbVie and Johnson & Johnson)

- Stelara, for Crohn’s disease (Johnson & Johnson)

- Fiasp and NovoLog insulin products, for diabetes (Novo Nordisk)

MONEY ISN’T EVERYTHING

Fifty percent of the 2,000 people surveyed by F&G Annuities & Life said they are considering delaying retirement or are thinking about going back to work and 40% of those said that money wasn’t the reason. What is the motivation? Simple – they want to have a purpose in life, they love what they do, and they want the mental challenges that come with work. Nonetheless, with inflation raging over the past two years, 60% cited money as a concern. The Baby Boomers who are retiring today are not the only cohort that find themselves rethinking retirement. Right behind them are the Gen Xers who are 7-15 years from the traditional retirement age of 65 and are saying the same thing.

ANOTHER CFP® PROFESSIONAL AT PROVISE

We are pleased and proud to present our newest CFP® professional – Holly Harman. While Holly is a new CERTIFIED FINANCIAL PLANNER™ professional, those of you who have been associated with ProVise for a long-time may recognize her name. She started at ProVise 23 years ago as a Client Service Representativ After graduating from college, she became a Financial Planning Associate working closely with our other advisors and their clients. Now, Holly has become an official Financial Planner. Please join us in congratulating Holly on this wonderful achievement.

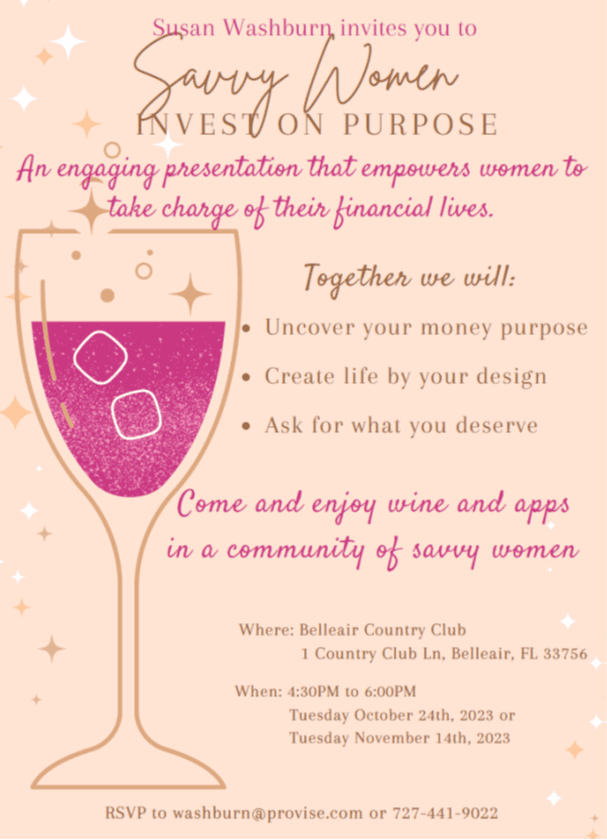

“SAVVY WOMEN INVEST ON PURPOSE” PRESENTATION BY SUSAN WASHBURN COMING IN OCTOBER AND NOVEMBER

For more information, see the invitation below to register for one of the events.

Proudly and successfully serving our clients for over 37 years. As always, we encourage you to call or email us if you would like to discuss anything.

Recent Comments