SAVVY WOMEN INVEST ON PURPOSE – OCTOBER 24th & NOVEMBER 14th

at the Belleair Country Club

Join Susan Washburn and our ProVise team as we help empower women to take charge of their financial lives.

See the invite below for all the details and remember to RSVP to Susan Washburn at washburn@provise.com or call 772-532-1625.

LABOR MARKET COOLING?

In 2022, by some measures, it was easier for an American to find a job than it has been in over 50 years. Individuals were quitting their jobs at a record rate for higher-paying positions. With fewer workers and more jobs, employers raised wages aggressively to attract new talent.

Many job seekers found themselves in a strong bargaining position and could name their terms both monetary as well as intangibles. As wages rose so did benefits such as flexible schedules and free lunches. But as economists like to remind us, there is no such thing as a free lunch.

Businesses’ profits got squeezed and the prices of everything from cars to eggs to sofas soared. Then the Fed’s Board of Governors raised the Fed funds rate from near zero to over 5% in what felt like a flash causing stocks and bonds to tumble, confidence to fall, and corporate profits to decline.

Despite the carnage the labor market hardly budged. Remarkably, the unemployment rate declined from an already low 4.0% in January 2022 to an even lower 3.4% the following year. In the meantime, wages moved in the opposite direction, increasing by over 6%. While the low level of unemployment is not in and of itself a concern for the Fed, wage growth is since wages feed directly into inflation and inflation continues to run uncomfortably high.

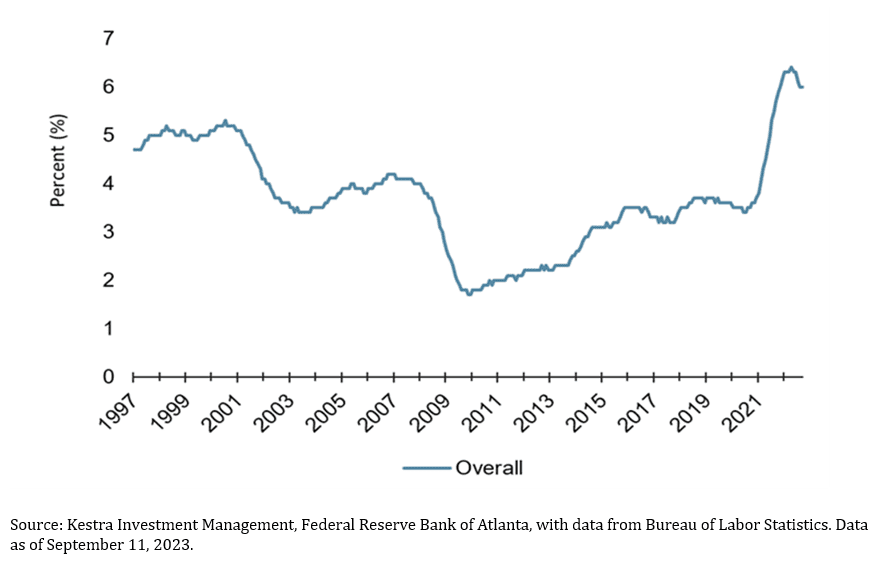

WAGE GROWTH

12-month moving average of median wage growth

With inflation slowing, but still uncomfortably high, the Fed faces a pressing question: Is the labor market slowing enough to further ease inflation?

Jobs are becoming harder to find. After a precipitous decline in workforce participation during Covid, more individuals are joining the workforce, driving participation rates closer to pre-pandemic levels. The percentage of workers voluntarily quitting their jobs has dropped back to the rate from 2019. More available workers mean less pressure on wages.

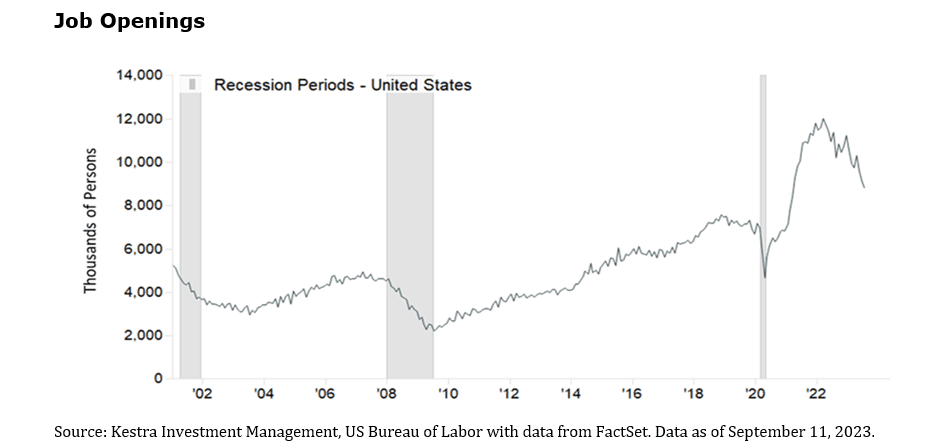

JOB OPENINGS

Despite this recent loosening of the labor market, it remains tight. Even though the number of job openings has fallen by about one third since early 2022, openings are still well above 2019 levels. Similarly, wage growth has eased from a peak of 6.7% in mid-2022 to 5.3% last month, but that latest number is still well above the pre-Covid rate of 3.7%.

For now, with the trend of fewer job openings and more workers, Federal Reserve officials are taking a wait-and-see approach. Broad price measures suggest that inflation is receding, but the Fed will watch for wage growth to soften further. In the meantime, stocks have staged an impressive rally, rising over 16% year to date, as investors bet that a softer labor market will translate to softer inflation.

BAD NEWS ON INFLATION, GOOD NEWS ON SOCIAL SECURITY

Earlier this month the August inflation data was released and showed a month-over-month gain of 0.6% up from 0.2% in the previous few months. As a result, the Senior Citizens League raised its estimate for an increase in Social Security benefits from 3.0% to 3.2% raising the average recipient’s benefit by $57 monthly. Of course, many will not see all of that increase as Medicare premiums are likely to increase. Stay tuned as we await the 2024 Medicare premium increases due in November.

WHAT DOES THE UAW STRIKE MEAN TO THE ECONOMY

Several weeks ago, union workers’ contracts expired without an agreement. Lacking a resolution, UAW organizers made good on their threat to launch strikes at three different companies: Ford, GM, and Stellantis, the maker of Chrysler, Jeep, and Alpha Romeo. They subsequently launched additional strikes expanding the walkouts.

With car prices already high, energy prices climbing, and wages rising faster than the Federal Reserve is comfortable with, what will the impact be for the broader economy?

Impact on Workers

After decades of declining union membership, unionization drives have grabbed headlines over the last couple of years. Unions continue to expand their reach at companies such as Starbucks and Amazon, as well as in industries such as Hollywood media. Some union negotiations, such as United Airlines and UPS, have successfully raised workers’ wages and improved working conditions.

Despite these developments, union membership continues to decline. Just 10% of American workers belong to a union, a level last seen in 1934. Interestingly, even with union membership declining, a growing number of Americans support unions.

Partly, the auto workers’ strike is about sticky inflation. With car prices roughly 22% above pre-covid levels and wages 18% higher, it would be easy to assume that both workers and auto companies would feel satisfied. Instead, inflation has driven the price of a wide range of goods and services ever higher, eating into both company profit margins and the workers’ buying power.

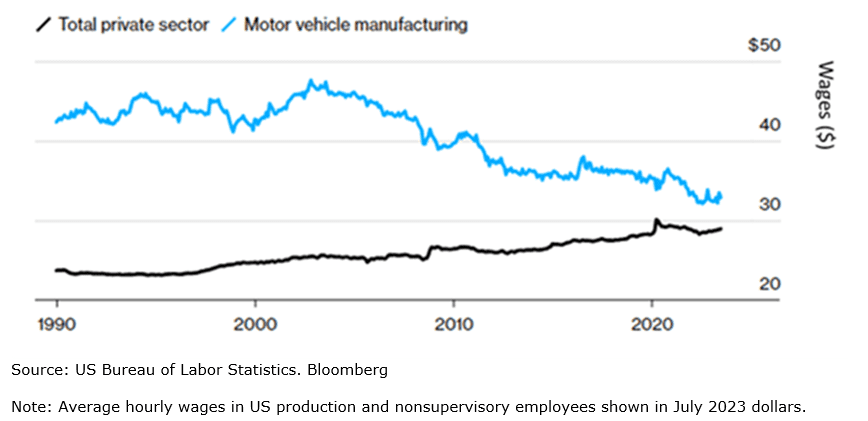

Real Wages: Auto Workers versus All Private Sector Workers

That said, this is not just about inflation because autoworkers’ real wages have fallen by 30% since their 2003 peak, well before inflation began to rise. At the same time, real wages throughout the U.S. have increased and, as UAW negotiators are quick to point out, auto companies’ managements have enjoyed large pay increases, helped by a strong stock market as much of this compensation came in the form of stock grants.

Union negotiators point to the disparity in compensation between a typical worker and the companies’ leaders. In this disparate experience, the auto companies are not unique. In aggregate, the compensation of America’s CEOs has grown to be nearly 400 times while the average workers’ compensation has grown 20 times since 1965. Given this growing disparity, workers at the auto companies are likely to continue to tip the scales back in their favor. We are not justifying fujhhhhhhhor against this difference in pay, we are just stating the facts.

Impact on the Auto Industry

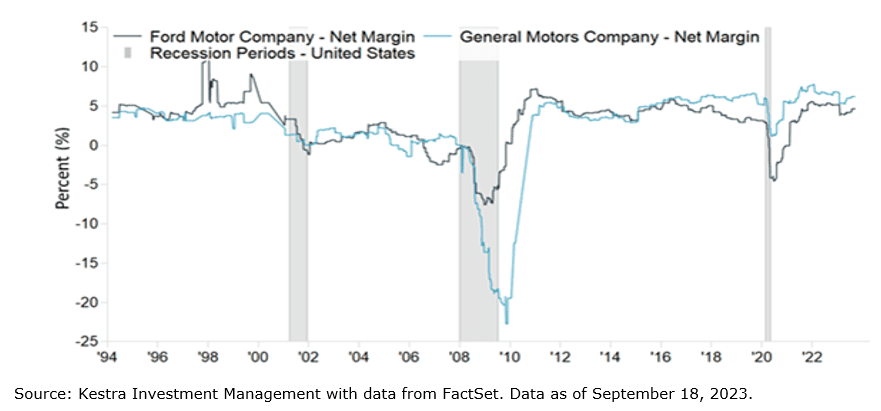

The UAW is likely emboldened by the fact that auto maker profit margins have rebounded. Though it’s worth remembering the potential fragility of the business model; it was only fifteen years ago that both GM and Ford required massive bailouts from the government to survive. Only three years ago the pandemic interrupted supply chains and shut down factory floors, reducing the number of cars the industry could manufacture. Also, keep in mind that auto manufacturers are producing more electric vehicles and have not figured out a way to make a profit let alone compete with the likes of Tesla.

In the near term, fewer workers certainly mean fewer new cars and lower profits for the manufacturers. Longer term, even as production ramps up, the companies will face higher wage and benefits costs. However, the impact appears limited. The UAW strikes have focused on a handful of factories that produce midsize trucks and SUVs. While these models are among the more profitable for the auto companies, they represent a small amount of industry market share. If the strikes continue to expand, they will have an increasingly bigger impact on the companies, workers, and the economy.

Ford and General Motors Net Margin

Impact on the Broad Economy

The auto industry accounts for 3% of the U.S. economy. While not insignificant, the industry’s importance to the overall economy has diminished. In a full strike of all auto workers over ten days, the economic toll could reach $5.5 billion between lost wages and lost profits of the auto companies and related businesses. While a large number, it pales in comparison to the overall revenue of motor vehicle and parts dealers in the U.S. of $1.5 trillion.

Perhaps, the biggest risk to the broad economy is that a prolonged strike could start to drive up car prices once again, just as gas prices are also rising. Auto inventories had begun to rebuild after a drastic decline during Covid, but they remain at about one-third of their pre-Covid levels, leaving little cushion should production fall dramatically. With fewer new cars available, the average price of a new car remains over 20% above pre-pandemic prices. Even the threat of higher prices could drive car buyers to make purchases sooner than planned creating a sense of scarcity and further drive up prices.

The UAW strike marks a new chapter for the auto industry with workers and management openly pitted against each other. Though both sides still appear far apart, union members seem poised to make some gains in wages and benefits. How big those gains are remains to be seen. Given that neither side can afford a protracted battle, the strikes are unlikely to drag on for an extended period of time, which also limits the broader economic impact. Workers in other industries are watching closely.

LONGER TERM BONDS ARE BECOMING MORE ATTRACTIVE…ALMOST

Investors pay close attention to the U.S. Treasury market and Treasury bond prices are seen as an indicator of market sentiment. In volatile times, investors buy Treasuries for safety in what is considered a risk-free asset. Plotting the yields of Treasury bonds across different maturities creates the Treasury yield curve. A healthy yield curve slopes upward, rewarding investors with higher interest rates to compensate for lending out their capital for longer periods.

In the early days of the pandemic, yields dropped across the curve as investors flocked to safety on the long end of the curve. As vaccines were created and the world began to reopen, consumer confidence grew, and investors dumped their longer-term Treasury holdings in search of riskier assets thereby increasing yields on the long end of the curve (bond yields and prices move in opposite directions). The short end, however, was anchored by the Fed funds rate so the spread between the two grew. That dynamic changed at the end of 2021 as inflation took hold and spreads moved toward negative as the Fed began to raise rates in the Spring of 2022. The yield spread between 3-month Treasury bills and the 10-year Treasury bond turned negative last year and continued to decline through the first half of 2023. Many consider this to be a harbinger of an economic recession and it was a key talking point for those anticipating one this year.

As the Fed has slowed its pace of rate hikes amid cooling inflation, the spread has begun to reverse over the last few months. This curve normalization is being met with varying bullish and bearish opinions. We view this as a positive development. Properly functioning markets should reward investors for lending capital over longer periods and is in line with our “higher for longer” view on interest rates. The yield curve still has a long way to go before turning positive once again, but when it does, longer-term bonds could finally be an attractive investment.

We hope you continue to stay safe and well.

Proudly and successfully serving our clients for over 37 years. As always, we encourage you to call or email us if you would like to discuss anything.

Recent Comments